The payments landscape has evolved dramatically. A decade ago cash was still the dominant form of payment. Yet by last year, less than a fifth of retail transactions were made using cash and the shift to a cashless society has been accelerated even further during the COVID-19 pandemic, with many retailers refusing to accept it altogether.

The pace at which payments are transforming continues to increase. In a few short years, online payments have gone from being hailed as revolutionary to being dismissed as archaic if they do not encompass the growing array of features, rewards and security layers desired by consumers. The expectations of millennials, in particular, have forced fintechs constantly to re-evaluate how payment solutions can be more convenient, creative and secure.

Mobile technology is now at the forefront of the payment industry’s evolution as the overwhelming majority of consumers rely increasingly on mobile apps for a variety of transactions and other banking services.

As digital natives, the younger generations who use online payment methods the most have already learnt to manage all aspects of their financial life on their smartphones. As a result, tech firms and financial institutions alike are racing to lead the drive towards mobile payments. Accenture predicts 64 per cent of consumers will use a mobile e-wallet service this year, up from 46 per cent three years ago.

Lockdowns around the world have given many organisations the time to step back and observe consumer behaviour in light of the pandemic

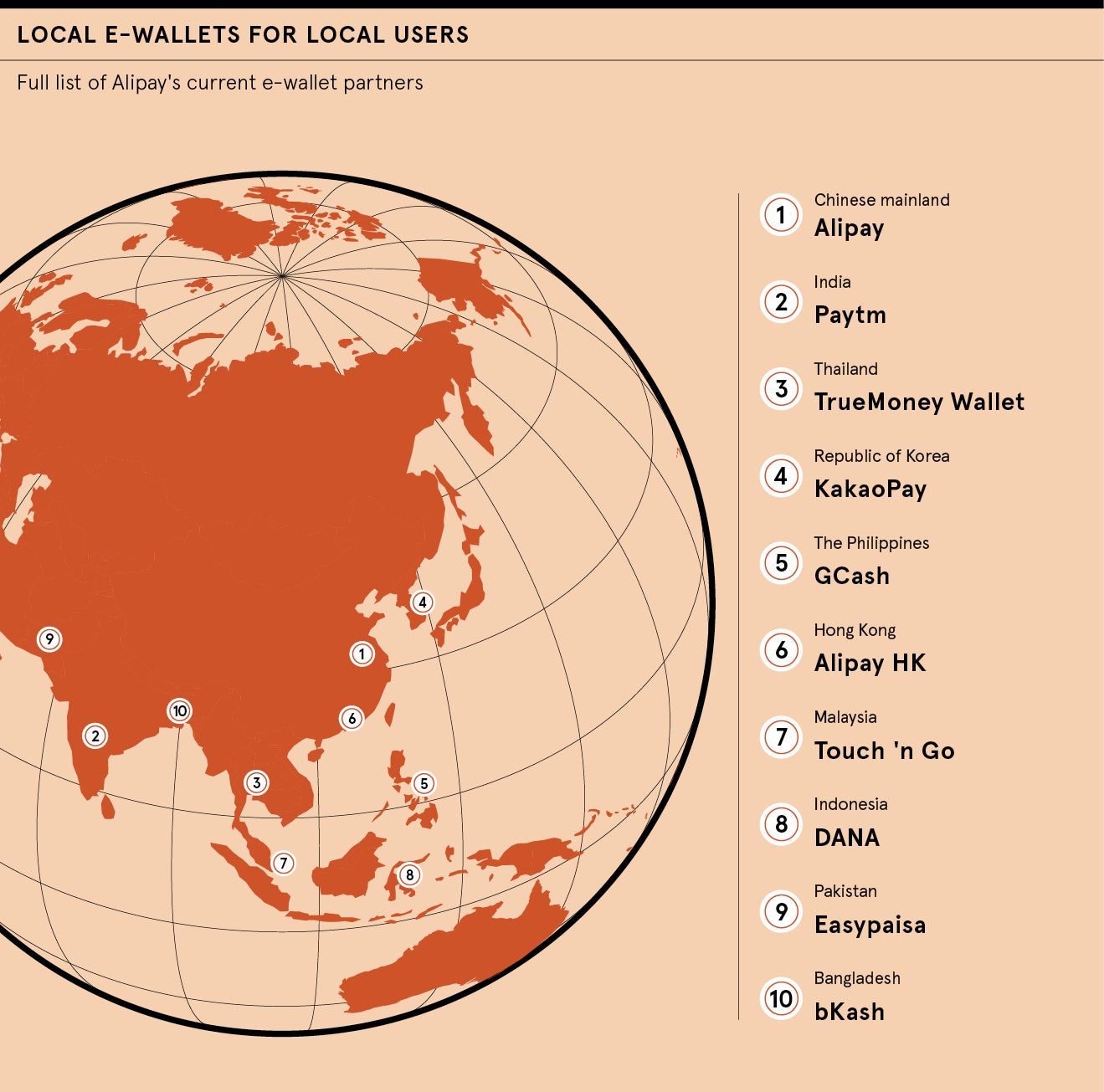

E-wallets combine numerous features craved by consumers, most notably unprecedented simplicity and convenience, supported by mobile integration, use across multiple platforms and robust security. Crucially, in an age of globalisation, they also facilitate cross-border transactions, eliminate the need to have a bank account with a physical entity and allow for payments in local currency. Statista estimates there will be 1.31 billion proximity payment transaction users by 2023, up from 950 million last year.

“The way people pay for goods and services may have transformed significantly in the last decade, but that’s nothing compared to the changes we’re expecting to see in the next five to ten years,” says Timea Benczik, payments director at online foreign exchange and contract for difference broker Exness.

“The arrival of blockchain has already been a game-changer as the technology underpinning cryptocurrencies, but its impact on payments is yet to be fully experienced. The anonymity, increased security and data veracity enabled by blockchain and cryptography will present many exciting opportunities in this space in the years ahead.

“Meanwhile, we also have the looming possibility of biometric payments becoming part of our everyday lives. But while biometric technology means a unique sense of security we cannot have through any other means of payments, the ethical concerns that come with it, particularly around privacy and personal data, need to be suitably addressed before it can reach widespread use.

“Personalisation will take the user experience of payment solutions to the next level, with artificial intelligence and big data the key drivers in collecting the transactional data of individual users and making it possible to build a unique user journey for each consumer.”

Payments are, of course, the livelihood of businesses and failing to meet increasing demands can be detrimental. While the vast majority of fintech companies are generally keeping up with customer demands in this field, evolution of this scale within a business is no easy feat and requires heavy investment both in technology and skilled personnel.

“If there are businesses that are being held back from adapting as quickly as what would be ideal, this is most likely the reason,” says Benczik. “This also depends on the industry. In the online brokerage world, for example, there is much more to consider when offering the best payment method for clients, including compliance and regulation. Brokers always look for trusted partners with low fraud ratings to ensure the highest level of know your customer.”

Most organisations are going through a challenging period in light of the COVID-19 pandemic. Yet while the near-shutdown of the economy has undoubtedly been staggeringly disruptive, it has also propelled many companies forward when it comes to remote working and presented a unique chance to reassess, re-evaluate and restructure numerous parts of their business. This includes the opportunity to look at their payment systems.

Electronic transactions have risen sharply with the introduction of social distancing, especially in the initial stages when people feared cash was able to transmit the virus and governments in countries such as Belgium and Italy made statements encouraging cashless payments. Italy, in particular, is a traditionally cash-centric country, but has seen the volume of ecommerce transactions increase by 81 per cent, according to McKinsey & Company.

The reliability of digital payments, thankfully, has experienced little interruption, earning plaudits for the robustness of infrastructures globally and spikes in public trust. However, the economic crisis resulting from the pandemic is certain to impact the payments industry, with the Office for Budget Responsibility warning UK GDP could fall by 35 per cent in the coming months.

An economic recession will affect revenues right across the payments ecosystem, though the upside is that when the world economy does resume, the same systems, and probably new ones, will be relied upon to facilitate recovery.

“Lockdowns around the world have given many organisations the time to step back and observe consumer behaviour in light of the pandemic,” says Benczik. “Given the unfortunate, yet almost certain, economic consequences that will follow, as well as the social behavioural changes we’re likely to see, companies have a solid timeframe in which they can plan, transform and adapt to the new reality that is to come.

“These behavioural shifts are likely to become more prevalent over the long term, including around payments, so it would be sensible for businesses and retailers of all sizes to use this time to ensure they can compete when it comes to providing customers with a variety of payment options.

“Generation after generation of consumers become increasingly demanding of digital services and this will not slow in a post-COVID world when people will want even more perks, creativity, security and control in the way they pay for things.

“Some of the key trends we’ve seen brewing include introducing social media platforms as a gateway to pay for a product or service, for example through the simple click of a buying button on the social media page of the business they are purchasing from. This behaviour has already been observed among the current generation, so the younger demographics that are true digital natives and even more inclined to interact on social platforms will almost definitely expect this.”

For more information please visit www.exness2b.com