In today’s turbulent environment, it might seem like the trade-off between risk and return isn’t as favourable as it once was, with political and economic upheaval across the globe seeing volatility jump, according to Reuters.

Even for investors with a medium-term investment horizon of, say, five years, the risk of loss that the equity markets bring might be too much to bear.

It’s why many alternative and potentially more stable asset classes have proved popular with investors over the last few years, such as energy, infrastructure or property. Investors have been hesitant in the past to consider such investments, as returns are traditionally difficult to benchmark, and they can be less liquid than the likes of equities. However, new technology is managing to overcome these barriers to entry.

Take peer-to-peer (P2P) lending, for example. By connecting those with money to invest with those looking to borrow, it allows you to target what could amount to a healthy, inflation-beating return, with less of the ups and downs of the stock market. And transaction costs are often minimal, too, with many platforms totally free to use.

Property-backed P2P lending in particular has proven popular because the loans are secured on bricks and mortar. It means, should the borrower be unable to repay the loan, the property can be sold to help pay the debt, ultimately reducing the risk to the investor.

However, remember that your capital will still be at risk and investments in property can be affected by

market conditions.

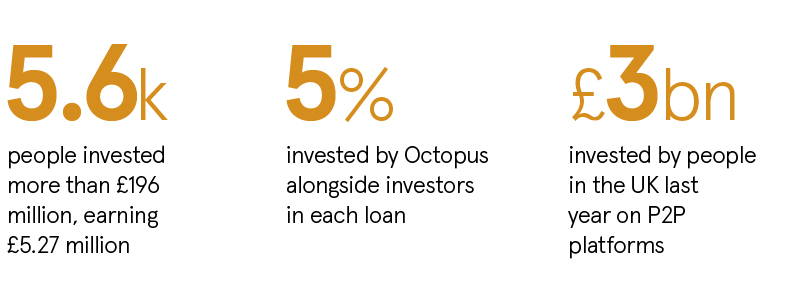

The P2P sector came to being in 2005 and has seen dramatic growth since. In 2015, it was also approved to be included within the ISA wrapper, so interest earned through eligible P2P platforms can now be tax free. In 2016 alone, people in the UK invested £3 billion through P2P lending platforms, according to a 2017 report by MoneyWise.

Octopus Choice is one example. It enables everyday investors to invest their money in a diversified portfolio of property loans. To reduce the potential for downside, all loans are made with a maximum loan-to-value ratio of 76 per cent, although the current July 2018 average is closer to around 61 per cent. This means the value of the asset would need to fall quite some way before any capital would be lost.

What’s more, Octopus invests 5 per cent of its own money in every loan and this is put at risk ahead of an investor’s. It’s totally free to use, too, and you’re able to request a withdrawal at any time, but it’s important to note that with any of these sorts of offerings, instant access can’t

be guaranteed.

So far, Octopus Choice has helped more than 5,600 people invest more than £196 million, earning £5.27 million in the process. Although it must be noted that past performance is not a reliable indicator of future results. And P2P lending, like all investments, comes with risks. Octopus Choice is not a cash savings account; your capital is at risk and interest is not guaranteed. You may get back less than you put in.

Is the property ladder leading you nowhere?

P2P lenders are also expecting an influx of interest from the unsettled buy-to-let sector. A raft of new legislation introduced in 2016 may have dramatically reduced the appeal of being a landlord. Stamp duty was increased by 3 per cent for those buying second homes, while landlords were told they are no longer able to make tax deductions for wear and tear.

Furthermore, higher-rate taxpayers are now unable to offset their mortgage interest against rental income, when calculating the amount of tax to pay. The Financial Times reported in June that already buy-to-let is falling in popularity as a result of these tax changes.

And it’s not hard to see why. Research from Octopus in May shows that if house prices grow at 2 per cent a year and not 3 per cent, and the buy-to-let property in question is yielding 4.5 per cent, the investor could lose money after all costs are incurred. Whereas data from the Bank of England suggests yields are now at their lowest since records began in 2001.

With some buy-to-let investors beginning to see a strain on their returns and all the work that can come with being a landlord starting to feel like too much effort for too little reward, it might leave some asking the question: is there a better place for me to put my money?

New choice

So, whether you’re a buy-to-let landlord who has decided the returns are no longer worth the hassle of renting, or a stock market investor who’s tired of the heartache brought on by the volatile stock market, the growing P2P lending sector might finally have provided the alternative you’ve been looking for.

The growing P2P lending sector might finally have provided the alternative you’ve been looking for

Take a look at octopuschoice.com or download the Octopus Choice app to find out more