At the new decade’s dawn, it is constructive for the insurance industry to reflect upon the societal changes that have been wrought since the turn of the millennium and accelerated through technological advancements. Is insurance keeping pace with changing demand?

Consider that the smartphone era, triggered by Apple launching the iPhone, began only 13 years ago. And that Uber and Airbnb, leaders in the sharing economy, are both under a dozen years old. New businesses and economies are emerging all the time to support how we live as a society.

The reality is technology has changed the way we live. We don’t visit the high street in the same numbers, in urban areas car ownership is changing and how we move around is now full of choice. We expect food, parcels and the like to be delivered quickly to our door, at the swipe of a finger or click of a button. These services and new economies may be modern, but they still require protection from one of the oldest industries in the world: insurance.

While technology has powered the gig, sharing and new mobility economies, there is a critical need for the insurance industry to adapt, modernise and close the gap on customer expectations.

Protection for people, parcels and pizza

Traditional insurance is too rigid and slow. For example, think of picking up a city car for an hour, an Uber or the items delivered by a courier or pizza company. All these require real-time protection of varying degrees and for the end-user experience to be seamless.

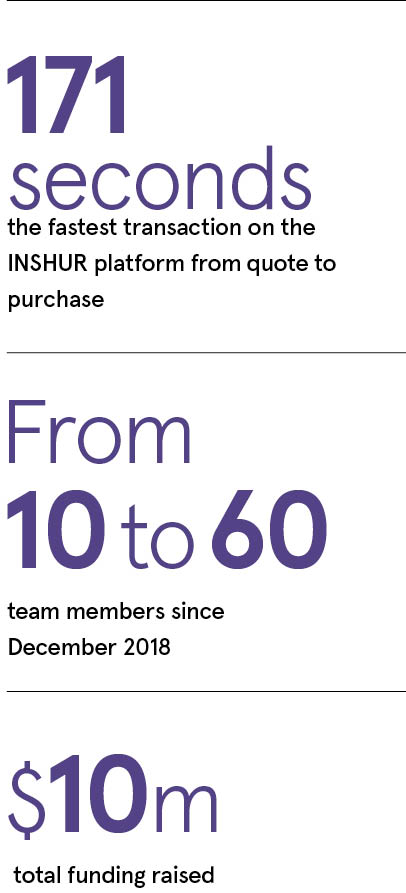

At INSHUR, which launched in New York in 2017 and the UK in late-2018, we have built a technology platform on which we sell insurance products to respond to these emerging economies. We have proven our platform within the private hire and ride-share space, and are now extending our reach into new vertical industries and further territories.

There is a critical need for the insurance industry to adapt, modernise, and close the gap on customer expectations

INSHUR offers something very different from traditional insurance experience. Firstly, our platform is accessible via a mobile app, so unlike a traditional broker, we are accessible 24 hours a day, every day of the year, thereby putting the end-user in control. And rather than spending hours or even days on the phone liaising with a broker, unravelling reams of documentation, our customers scan their driving licence and private hire licence, and enter their vehicle registration number to receive a quote.

Age of the API and alternative data-led insurance

By using APIs (application programming interfaces) to integrate with our partners, we can securely pull through data during the quoting process, which means the customer needs only answer a handful of questions.

That makes our service much quicker and more convenient for drivers, whose top priority is to be on the road so they can earn money, and we help them do just that. Indeed, one driver was able to get a quote and purchase cover in only 171 seconds.

Not only do these new data integrations help to make roads safer by immediately notifying our partners if a driver’s policy lapses, they also provide new and dynamic underwriting factors that can complement pricing decisions. This data transfer is in real time, much faster than waiting for a customer to tell you they have moved house, changed vehicle and so on.

Not only do these new data sources significantly improve the customer experience, they also ensure the policy is being priced at a level which safeguards the long-term viability of the insurer. This ultimately protects the customer and reduces any potential friction when a claim is filed.

Driven by customer invention

We realise that customers are the beating heart of what we do; their concerns come first and help drive our progress. From the outset, we have engaged with drivers on a one-to-one basis every single day, to understand their painpoints better and how we can solve them. We want to get drivers on the road faster, reduce paperwork and provide them with an exceptional customer experience.

It is thanks to customer feedback that in September we launched our new Flex products. The first of its kind in the UK market, Flex allows private hire drivers to pay for their insurance only when they are on the road. Additionally, at the start of this year, INSHUR introduced a concierge-style insurance policy for Uber Pro drivers, offering discounts of up to 20 per cent off their premiums.

As the traditional insurance players grapple with modernising their products, at INSHUR we have worked hard to gain the trust of customers, being rated “excellent” on Trustpilot and earning an average of 4.8 stars from more than 3,000 app store reviews. Moreover, around 50 per cent of our growth is attributable to word-of-mouth recommendations.

That excellent reputation, and that we are part of their conversations, is a powerful indicator our products are meeting a need. The “talkability” within our customer base is almost unheard of in the insurance space, after all no one really loves insurance, and will help us make inroads into other markets in the coming months.

Using our platform approach, connecting with partner APIs and being data led means we can enter new markets faster. It is clear there are huge opportunities that have been presented by new economies and a new kind of insurance protection is required.

At INSHUR we have built a technology platform that works perfectly for the ride-share and private hire markets, but it can easily be applied in other verticals. Our alternative data sources power better underwriting decisions and the speed of cover we offer is what these new economies ultimately demand.

For more information please visit inshur.com/uk