SPONSORED BY WorldFirst

UK businesses with overseas operations have been handed some harsh lessons during 2020 as the economic mire from the coronavirus pandemic manifested on company balance sheets.

Currency market volatility and supply chain interruptions caught out hundreds of companies during the early weeks of COVID-19, highlighting the importance of comprehensively managing foreign exchange risks through a structured strategy with a chosen partner.

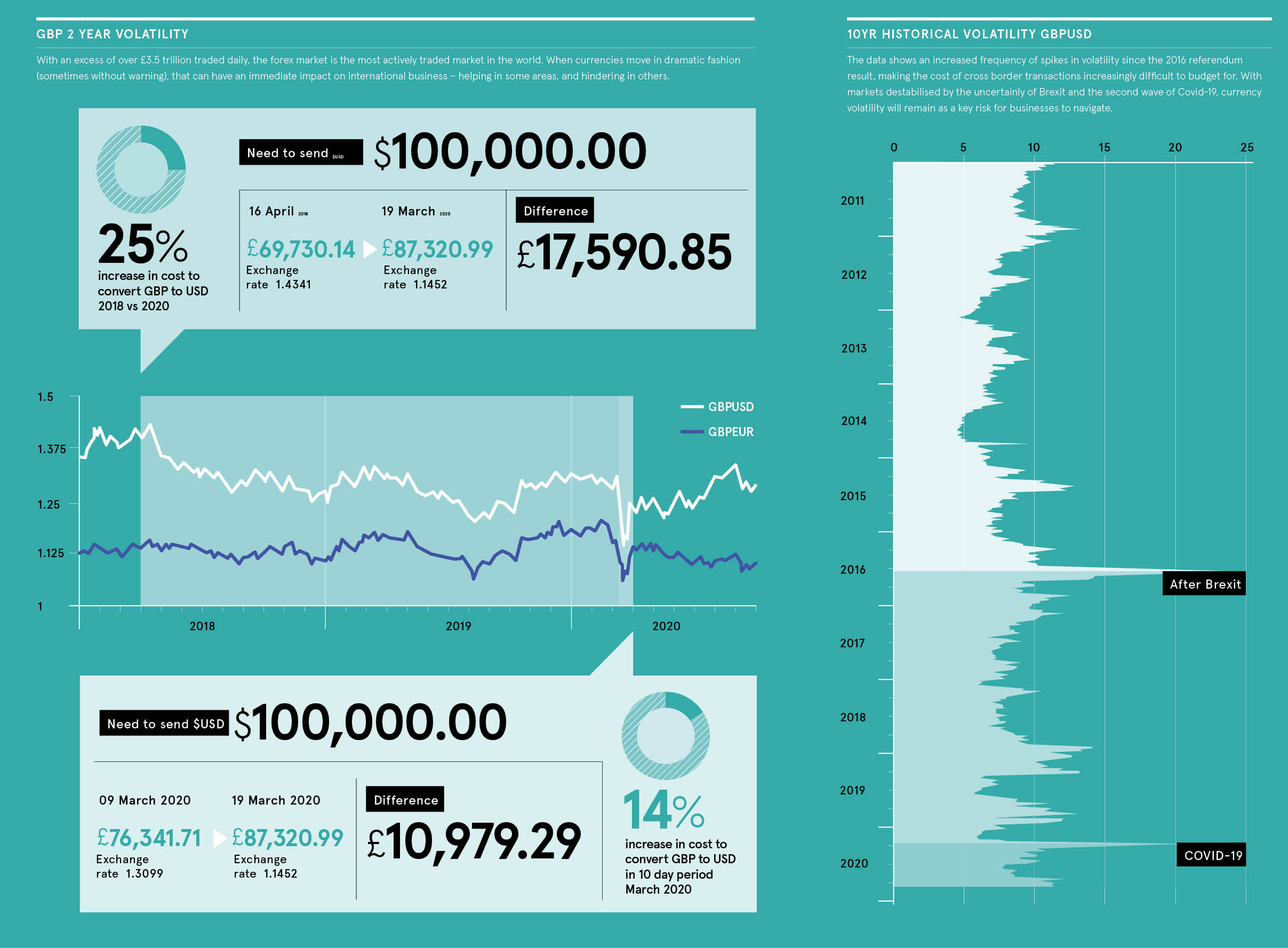

In the relatively calm markets of recent years, some finance directors may have overlooked developing a company-wide foreign exchange policy. While there was a spike in volatility in 2016 after the Brexit vote, 2018 and 2019 were relatively calm.

But in 2020, this would have proved costly. On March 20, sterling fell to its lowest level against the US dollar for 35 years, with the GBP/USD exchange rate moving from 1.3157 to 1.1494 in the space of a few days.

Those companies that were making US-dollar payments from sterling during that period, without any forward contracts in place, would have seen a dramatic difference in the amounts paid from the same payment were it settled on March 10, compared to March 20.

Furthermore, if they were relying on their traditional provider of banking services, they may have been additionally hit by uncompetitive exchange rates, delays in settlement or higher charges for the service.

“Up to 85 per cent of small and medium-sized enterprises use their banking partner for cross-border foreign exchange payment services,” says Daniel Howe, managing director, Europe, Middle East and Africa, at WorldFirst.

“Because they have a trusted relationship, they tend to use their banking provider for multiple services, but that can sometimes mean they get the raw end of the deal.”

If they haven’t already done so, company directors with significant overseas transactions should move quickly to help mitigate against further volatility, with predictions that markets are likely to continue their unpredictable behaviours well into 2021.

Forward planning

Those seeking greater visibility of their future costs may opt to use a forward contract. Forward contracts allow you to secure an exchange rate for a defined period of time in the future, helping with cash-flow planning and potentially mitigating currency risk.

By embracing this approach, company directors can more easily budget for future revenues, costs from overseas transactions and book transactions ahead of time, yet funding them at a later date.

“Forwards are particularly relevant to businesses in the current market due to the volatility,” explains Howe. “They offer a degree of certainty at a time when businesses will be considering plans for the next year.

“Companies may need to agree pricing with a supplier and, if they are buying or selling at spot, that is an unknown.”

While forwards can be a useful tool for fiscal planning, finance directors should be aware that a lack of transparent pricing can sometimes be used to inflate providers’ profits.

“When considering the cost of a forward contract, other variables such as the interest rate differential between two currencies can affect the price,” explains Tom Kiddle, head of commercial at WorldFirst.

“Many customers do not have visibility of these variables and how they affect the price of the underlying contract. In many cases, the customer has little certainty of the margin they are being charged for using a risk management product.”

By comparison, WorldFirst explicitly breaks down how it has priced its service upfront. Forward points are never used as a mechanism to charge more, but are instead used to reflect interest rate differentials between two currencies.

Digitalisation and global trading

The World Trade Organization suggests the pandemic may result in increased levels of international trade longer term, which means the use of currency risk management solutions could become a popular and prudent choice for businesses.

“The global nature of COVID-19 and its impact on ecommerce may encourage strengthened international co-operation and the further development of policies for online purchases and supply,” it concluded in a May 2020 ecommerce report.

Yet, while businesses have been quick to embrace online trading, many have not considered the consequences of generating revenues in multiple jurisdictions.

“The reality is, as soon as you move online, you are global,” says Howe. “Until now, foreign exchange may not have been a major point of consideration for some, but there are lots of businesses in the UK, trading globally for the first time, exposed to risks they may not fully understand.”

This under-appreciation of currency risks can partly be attributed to the traditional opacity of the currency exchange market.

Most traditional providers are willing to quote you a rate for the a transaction but few are willing to offer a cost. They may make additional charges for services such as account opening or annual maintenance.

It can also be very difficult to compare exchange rates in real time as markets move so quickly. So, if businesses call multiple providers, they won’t be comparing rates at the same point in any one day.

Worse still, a company may receive introductory favourable terms as an incentive for them to use a provider’s service, only to see this rate deteriorate over time.

In an attempt to navigate this complexity, WorldFirst has designed a clear fee structure, based on the annual amount transferred in any one year. Customers with annual transaction volumes up to £500k are charged 0.5%, between £500k and £5 million 0.25% and above £5 million 0.15%.

Multiple uses

COVID-19’s effect on international business has already been profound. For the global travel and tourism market, there has been enormous disruption. Airlines have faced mass cancellations and refunds, while hotel bookings between hoteliers and travel companies have also been withdrawn.

Finance directors operating in the travel sector have needed to handle refunds from foreign market suppliers while wanting to avoid converting this cash back into sterling and crystallising a loss.

“The travel industry has seen a recent increase in the amount of refunds received from cancellations, particularly at the start of lockdown,” says Kiddle.

“By being able to serve our customers with a local collection account, our customers have been able to avoid multiple exchanges, into sterling and then back into the local currency at a later date. In an industry where margins are tight, having access to a local collections solution will create an important cost-saving.”

For companies without a bank account in each local jurisdiction in which they operate, WorldFirst offers currency accounts that can be opened in a matter of seconds.

Unlike traditional bank processes, which require an individual to be physically present, WorldFirst’s registration service for opening a currency account allows a customer’s credentials to be verified digitally.

“Trading abroad can often be an alien environment for some companies,” Howe concludes. “Through our World Account proposition, we offer a single platform that provides customers with local domiciled currency accounts in ten global markets.”

For more information please visit www.worldfirst.com

Q&A: International growth at the click of a button

A boom in businesses trading on digital marketplaces has underscored the need for local currency accounts, but what do companies need to consider as they go global?

Theo Sprague, Head of relationship management, ecommerce & Daniel Howe, Managing director, Europe, Middle East and Africa

Why have companies targeted international expansion through online sales platforms?

DH: The emergence of online technology has made it easier for small and medium-sized enterprises (SMEs) to reach international consumers. International trade has become simpler. Marketplaces like Amazon have made it almost frictionless to sell products in international markets at the click of a button. It is now as easy to sell a product in Australia as it is in the UK. At the same time, logistics and the cost to send and ship goods has come down significantly. I can buy a product from China, have it shipped to the United States and I don’t even have to leave my office in London.

What impact did COVID-19 have on international cross-border sales on these platforms?

DH: The digitalisation theme has accelerated as a result of COVID. People who weren’t buying products online six months ago are now shopping online. Now they’ve started, they are likely to continue. We have seen a fundamental social shift in behaviour.

TS: It has had a profound effect on our ecommerce business and further accelerated the high street’s demise. It is super easy and cheap. During lockdown, the sales volumes have been comparable to peak periods like Black Friday or Christmas and for many it was only a matter of supply chain limitations preventing even greater success.

How has the financial services industry kept pace with this change?

DH: In many ways, financial services hasn’t caught up in the same way. It still presents a barrier for SMEs operating internationally. During the pandemic, there have been restrictions on people crossing borders in many countries, which has made it more challenging to open traditional bank accounts in some jurisdictions. That’s why we believe in the importance of our World Account proposition. The account is a virtual account that provides customers with a locally domiciled currency account in ten global markets. I can get accounts in US dollars, or Australian dollars etc, locally domiciled in those countries same day, to make payments to local suppliers.

TS: Traditionally the acquisition of an overseas bank account is very laborious. You need a physical account in that territory. But we offer a way of having a whole suite of currency accounts around the globe all on a single platform. We made a huge hurdle into a tick-box exercise by offering a viable alternative, without the trade-off of security or peace of mind.

With COVID-19 restricting international travel, have you found interest from larger corporate customers for this product?

DH: The speed of access we offer to new markets is appealing and we have seen an increase in registrations from businesses that are opening up to new markets and seeking alternative ways of collecting international funds. This means bigger businesses that were previously offline businesses now need these accounts.

How are companies likely to approach international expansion in the future trading environment and what role will WorldFirst play in supporting that?

DH: International expansion will be digital first for all companies in the future. The process we have been through has pushed business online. We want to be an enabler of international growth, to support businesses in taking their business abroad. They need a broader range of services than just payments and collection products. Companies will increasingly need new products and services in international markets. For us, the important thing is we have a great core product, but we recognise SMEs will need more. The product suite we provide must continue to support our customers’ growth because their international success is our success.