Q: Metapack’s data shows the coronavirus pandemic has forced retailers to accelerate their digital operations. How has the industry been affected?

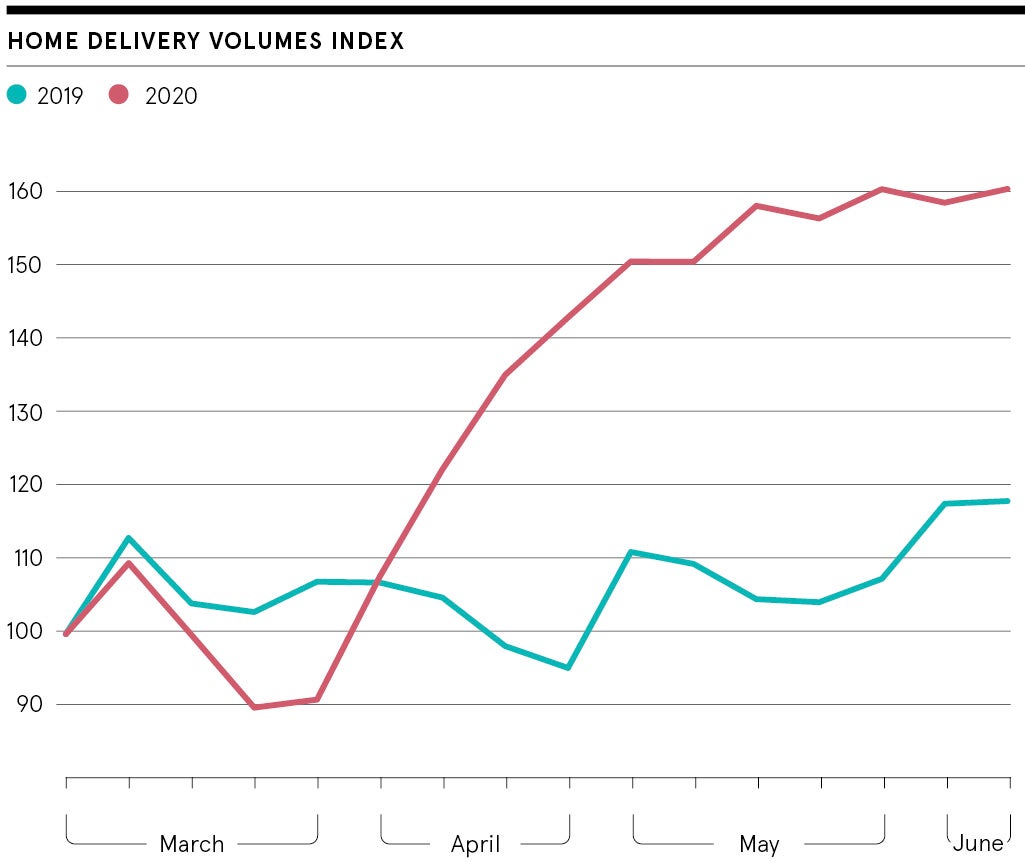

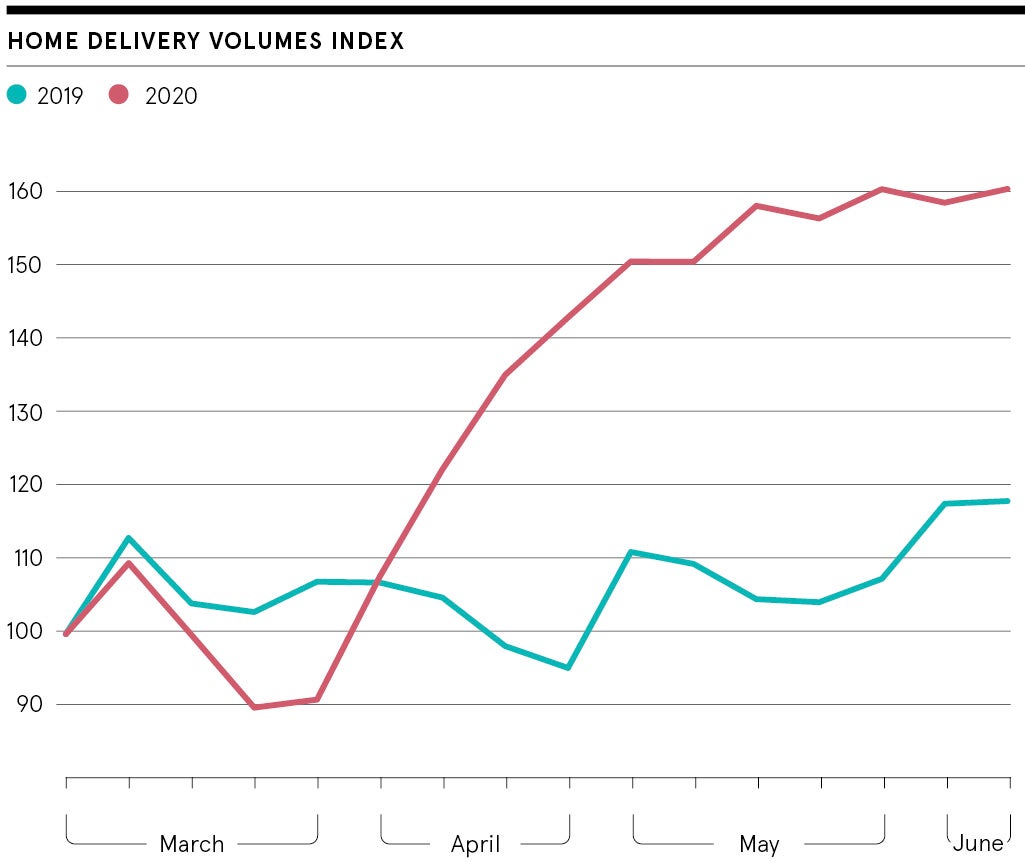

A: Every year, retailers rigorously plan for the Christmas peak, when delivery and returns volumes reach their maximum. However, in the UK throughout April and May we have already seen volumes exceed the online shopping peak of 2019 and by an additional 24 per cent on top. While this is great news for sales, it also generates customer expectations that challenge even the highest-capacity supply chains. One online fashion retailer we work with has the capacity to send 30 million UK parcels a year and it has still found itself under pressure to meet current demand. On the one hand, physical store closures have driven more people online, while social-distancing measures in warehouses have reduced capacity and created backlogs: it’s a perfect storm. Even as physical stores begin to reopen, orders continue to rise and create havoc for supply chains.

Q: And how have consumers reacted as a result?

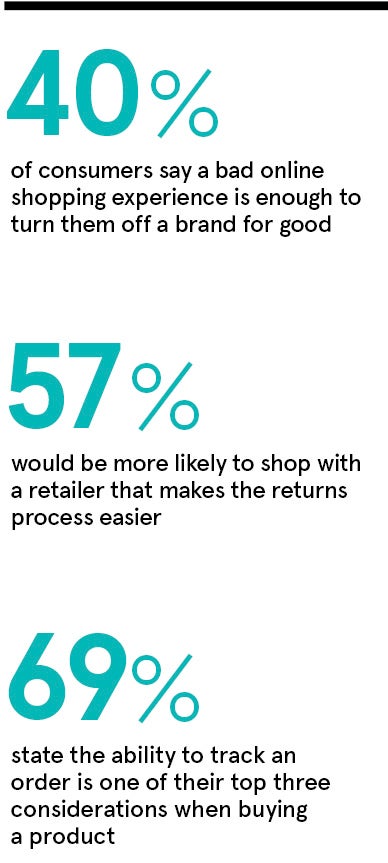

A: Consumers have become used to a certain level of service, before and after purchase. In fact, more than two thirds of consumers say the ability to track their order is one of their top three considerations when buying a product. So what happens when consumers don’t receive their orders in the timeframe they expect? Well, they call the retailers to find out where they are, of course. The problem with that is the massive cost it incurs for retailers. For one major UK high street chain we work with, customer care calls cost £4 each. And the number of calls this chain receives has more than doubled during the pandemic. This is typical for most online retailers. It’s not only the cost of meeting demand that’s at stake either, but also the cost of failing to do so: almost 40 per cent of consumers say a bad online shopping experience is enough to turn them off a retailer for good.

Q: What advice are you offering your customers to navigate the crisis?

A: One of the learnings from the pandemic is retailers need to invest more in their post-purchase experience. The most efficient and cost-effective way to do this is for retailers to make use of technology that connects them with multiple carriers, giving customers more choice when it comes to delivery and returns. Different carriers have different capabilities, from next-day delivery to pick-up locations. And yet retailers have typically struggled to leverage the full range because they need to create individual connections for each carrier, which is expensive, time consuming and ultimately limiting. The good news is there are solutions on the market that can do the heavy lifting for them. In fact, one of the reasons why retailers turn to us is because we can connect them with a wide range of delivery options for their customers, at last count almost 500 carriers and 5,500 delivery services. The popularity of technology like delivery-tracking solutions is also growing. Solutions such as our own Delivery Tracker keep customers informed as their order progresses, through SMS, email or WhatsApp notifications. Not only is this a better solution for consumers, it also relieves the pressure on customer call centres. Crucially, the retailer, not the carrier, owns the branding and communication with the consumer.

Q: More than half of consumers say they would be more likely to shop from a retailer that makes the returns process easier. Why is this?

A: Consumers often get frustrated if returning an item isn’t made easy for them. One of the solutions we offer retailers is to give customers a choice. When they want to return, where they want to return and how they want to return. It’s important to offer variety, which is why we connect retailers to 350,000 pick-up  and drop-off locations, such as a Royal Mail office, a Hermes or UPS parcel shop. Be it through a physical store or using a returns label, by giving retailers better visibility on what’s coming back to their warehouses, they can start processing those returns and better manage their stock before the items even arrive.

and drop-off locations, such as a Royal Mail office, a Hermes or UPS parcel shop. Be it through a physical store or using a returns label, by giving retailers better visibility on what’s coming back to their warehouses, they can start processing those returns and better manage their stock before the items even arrive.

Q: As bricks-and-mortar stores begin to reopen, what can we expect from the dynamic between physical and digital?

A: The reopening of stores is good for the economy, but due to ongoing social-distancing measures, the capacity of those stores will remain limited. And the patience of consumers to queue will be tested. Standing outside in the June sunshine while on furlough is one thing, but it will become a much less appealing prospect in the November rain. During the pandemic, we’ve seen a retailer shift in terms of category. The very high growth of fast fashion has been offset, to some extent, by massive growth in health and beauty, sport, electronics and toys. Their demand has gone through the roof. One area that we’ve been helping retailers to monetise is in turning their stores and inventory into mini warehouses. Holland & Barrett has implemented Metapack’s Ship-from-Store solution so they now distribute products from their stores as well as their warehouse, which also enables them to provide their customers with a richer experience, further accelerating their multichannel transformation led by chief digital officer Nick Thomas. If you order an item from Holland & Barrett and live 200 miles away from its warehouse, but ten miles from a store, being able to deliver to you from that store means you get it quicker with a lower CO² impact.

Q: Should retailers expect the current trend of digital acceleration to continue beyond the crisis? And if so, what is your advice to them?

A: Consumers who had previously resisted ecommerce have been forced to shop online and have had a good experience. We anticipate the growth in this category will be sustained long after the pandemic has faded and retailers will continue to invest heavily in the total online experience. The stakes to ensure business continuity have never been higher and this involves the ongoing ability to ship to consumers who are unable to visit in-store now and in the future. If a retailer relies on one or two carriers to ship their entire volume, the potential for capacity failure is more likely. And as we’ve seen, this carries a massive cost to retailers, both financially and reputationally. Even if your customers don’t place additional volume today, they very well might tomorrow. We already had Christmas in May, so what’s the actual 2020 peak of November and December going to look like?

For more information please visit www.metapack.com

Q: Metapack’s data shows the coronavirus pandemic has forced retailers to accelerate their digital operations. How has the industry been affected?

Q: And how have consumers reacted as a result?

Q: What advice are you offering your customers to navigate the crisis?