They are called the sandwich generation. These are people in their 40s and 50s who are supporting retired parents while simultaneously helping their own children. It’s a double whammy, as parents live longer than ever before, and the children often stay in education until their early to mid-20s, then need assistance with a mortgage. And there may be another tier as their children have children.

“You are increasingly finding four generations living under one roof,” says Alexandra Loydon of wealth management advisory St. James’s Place. “The demographic changes are profound. The sandwich generation are trying to generate a pension pot while supporting their families, which makes it harder to accumulate a sufficient amount.

“Worse, this is a time of major change to pensions and retirement. In particular, the rules have changed over how much money you can put into a pension. It adds up to a situation where many people are finding their original plans aren’t going to work.”

Research1 by St. James’s Place reveals the scale of the demographic changes. Just 7 per cent of today’s retirees support someone other than their partner, yet a quarter of those who aren’t retired expect to be paying for other people. The number of families with more than one retired generation is set to double to 1.2 million by 2039.

The prospect of an inheritance to compensate for being sandwiched is diminishing. Retirees are living longer, shrinking their estates. The research suggests the average inheritance is set to drop by more than £50,000 among wealthier families as a result.

Those who don’t take the right action could suffer. “Many people assumed they could retire at 55 and would live to 75,” says Mrs Loydon. “Current trends suggest that both of these dates are likely to be wrong. It is essential people rethink their planning.”

When should you retire?

Naturally, efficient pension planning requires estimating the age of retirement. Traditionally the two concepts are the same: you retire at the same moment you take a pension. But in recent years that concept has been unpicked. Workers now are encouraged to stay in the workforce past the pensionable age, if they want to.

Naturally, efficient pension planning requires estimating the age of retirement. Traditionally the two concepts are the same: you retire at the same moment you take a pension. But in recent years that concept has been unpicked. Workers now are encouraged to stay in the workforce past the pensionable age, if they want to.

Claire Trott, head of pensions strategy at St. James’s Place, says there are three reasons to keep working.

“Retirement can be traumatic. It’s tough to go from working five days to working no days. It makes more sense to slowly scale down, to say three days. There is research to show it’s better for your health. The longer you work, the longer your brain stays healthy.

There is the financial consideration. You may be able to keep paying into your pension or ISA, rather than withdrawing. This means you’ll potentially have more when you need it.”

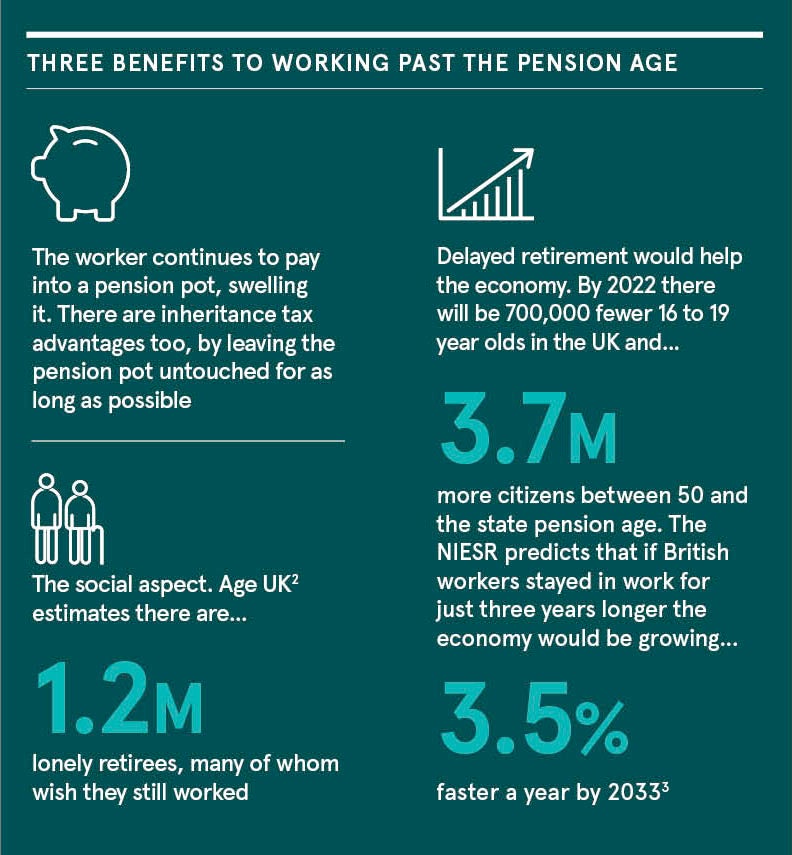

Former pensions minister Baroness Ros Altmann is a vocal campaigner on this issue. She wants British workers to understand that the retirement age and pension age are independent concepts. She says there are three benefits to working past the pension age.

First, the worker continues to pay into a pension pot, swelling it. There are inheritance tax advantages too, by leaving the pension pot untouched for as long as possible. Second, is the social aspect. Age UK2 estimates there are 1.2 million lonely retirees, many of whom wish they still worked. If they did they’d be happier and healthier. And third, delayed retirement would help the economy. By 2022 there will be 700,000 fewer 16 to 49-year olds in the UK and 3.7 million more citizens between 50 and the state pension age3.

The National Institute of Economic and Social Research predicts that if British workers stayed in work for just three years longer the economy would be growing 3.5 per cent faster a year by 2033.3 The Royal College of Radiologists says 40 per cent of its consultants will retire over the next ten years. It is pleading with them to work longer.4

Every individual’s case is unique. And the situation may change over time. Many sandwich generation individuals are discovering this, as their dual support for retired parents and children makes it harder to accumulate a decent pension. Delaying retirement age may be part of the solution.

“We have ripped up the rule book.” says Mrs Trott. “The consistent theme is that pension and retirement planning is about allowing people to do what is right for them.”

How to optimise your philanthropy

Another factor complicates the picture. Many people in the UK want to support a charity. Generous individuals use surplus cash for philanthropy. But it can be tricky to support both a charity and other generations in the best way. Members of the sandwich generation may be using their income and capital incorrectly.

“It’s about being tax efficient,” says Mrs Loydon. “It may seem obvious to donate surplus income to charity. The charity can claim gift aid so get an uplift and the donor claims income tax relief. So, it’s a popular strategy. But when people come to us for financial advice, we take a look at their wider picture. It may make more sense to change the way they give to charity and how they pass on wealth to their children.”

She explains a more advantageous approach: “For example, if a person currently gives surplus income to charity and plans to give capital to their children, we suggest they switch it around. Use the capital to support a charity and income to support children.

“The reason is inheritance tax (IHT) laws. If you give a relatively low amount to a child, you’ve got to live for seven years to avoid tax. Die within seven years, and the value of your gift is subject to IHT on a sliding scale up to 40 per cent. But by using the capital to support your favourite charity and income to support your children, you benefit from the surplus income exemption. It’s tax efficient. But most people don’t know about it.”

Value of expert advice

Ultimately, individuals of all generations are encouraged to seek expert financial advice. “It’s important the advice provided is holistic,” says Mrs Loydon. “This means talking to an advisory able to provide a breadth of expertise around more than purely investments, but tax and wills for example.”

Advice will illuminate all factors, from retirement age and pension provision, to inheritance planning and the best way to offer ongoing support to multiple generations. Research1 by St. James’s Place found 79 per cent of those who receive ongoing face-to-face advice believe they have sufficient funds to fulfil their retirement plans, compared with 35 per cent who don’t receive advice.

The pensions and retirement landscape is changing fast. But those who seek expert advice will be well placed to optimise their strategy and enjoy the future no matter what it holds.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than you invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances.

Advice relating to a Will or certain areas of tax, would necessitate the referral to a service that is separate and distinct from those offered by St. James’s Place. Advice in this area is not regulated by the Financial Conduct Authority.

Search SJP Retirement or visit www.sjp.co.uk/retirement to find out more.

¹ The Changing Face of Retirement, independently undertaken by Opinium on behalf of St. James’s Place, April 2019

² Age UK, August 2017

³ A New Vision for Older Workers, Department of Works and Pensions, March 2015

⁴ UK Workforce Census 2018 Report, The Royal College of Radiologists

St. James’s Place Representatives represent only St. James’s Place Wealth Management plc, which is authorised and regulated by the Financial Conduct Authority. Registered in England Number 4113955