In an era when the cost of capital is close to zero, what sets the best companies apart from the worst is the ability of chief executives to crack the “superaccelerator” code.

A study of 3,000 leadership teams by executive search firm Heidrick & Struggles showed that the top-performing teams delivered 22.8 per cent more economic benefit than the laggards.

It also examined the top 23 performing companies in the FT 500 and found they delivered three times the increase in wealth over seven years than the rest of the pack, equivalent to a $337 return for the best against a $111 for the worst.

The findings are outlined in a new book Accelerating Performance: How to Mobilise, Execute and Transform with Agility, written by Colin Price, executive vice president and global managing partner at Heidrick & Struggles, and Sharon Toye, a partner in the firm’s London office.

The findings are outlined in a new book Accelerating Performance: How to Mobilise, Execute and Transform with Agility, written by Colin Price, executive vice president and global managing partner at Heidrick & Struggles, and Sharon Toye, a partner in the firm’s London office.

What sets the top performers apart from the others, explains Mr Price, is their ability to build and change momentum more quickly than their competitors, in other words to accelerate performance.

He calls them “superaccelerators” and says they have cracked the code to being both big and agile, taking a disciplined approach to acceleration, reducing so-called time to value, the speed at which a business goal is reached.

Since so much study of leadership and management is based on anecdote or theory, the authors were keen to make theirs scientific, based on data and empirical evidence gathered from research into thousands of teams, studying FT 500 companies and the firm’s experience in placing 4,000 executives every year.

The idea for the book was triggered by a meeting with four top bank chief executives or CEOs and the realisation that each espoused near identical business strategies. Further investigation showed the same was true between rivals in 16 sectors, from car makers to airlines.

The difference in profit margin between the top-performing sectors and the worst was 19 percentage points, yet the difference between the best and worst within a sector was 34 percentage points.

What that shows is that execution is more important than strategy and with capital now almost free, the key to success is leadership talent and the ability to execute successfully.

“We have gone from an age of strategy to execution. Everyone is trying to strip out costs, digitise and flatten hierarchies. Talking to those bankers landed the idea that it’s not where you are going that is important, but how quickly you get there. It’s about accelerating,” says Mr Price.

He says the ability to think like an accelerator is down to the mindset of the CEO and the way it is passed through the values and culture of the organisation, in particular the top ten leaders.

For example, big banks are not only competing with each other, they face a major threat from the fintechs that started life in a garage on the West Coast of America.

“The mindset of those guys is simplicity, urgency and productive paranoia. They are not interested in levels of hierarchy or what the company policy handbook says. They want to smash the competition,” says Mr Price.

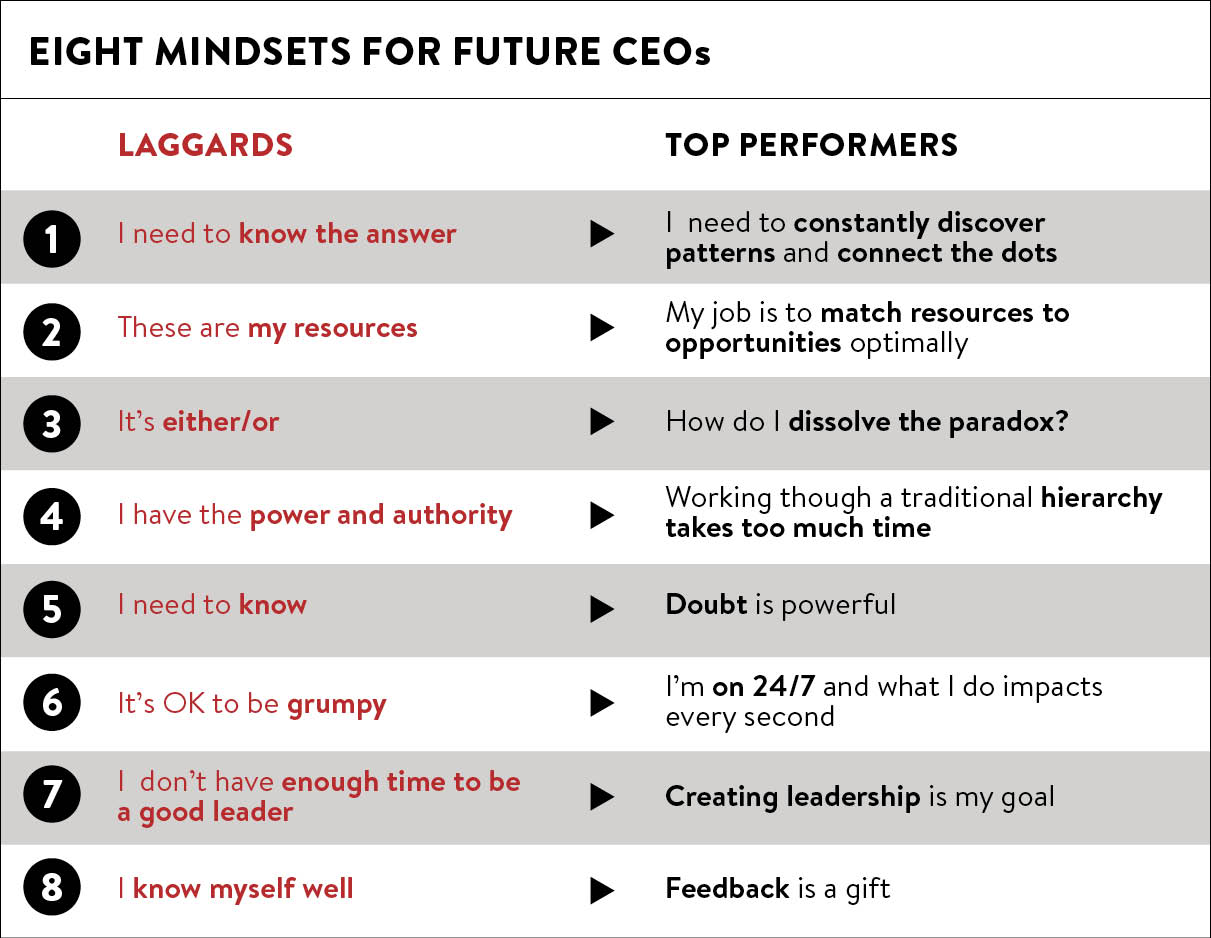

The book proposes that there are eight mindsets which are key to becoming a future CEO and those who exhibit the mindsets on the left are at risk of failure, while those best described on the right are more likely to be successful.

In the first, rather than saying “I need to know the answer”, the CEO is constantly seeking to discover patterns and “join the dots” in the world around them.

This ability to make sense of what is happening and react quickly is dubbed “ripple intelligence” by the book’s authors.

It requires the CEO to take a top-down view of trends and events causing ripples in company’s environment, and to give the leadership team the time to step away from the day-to-day and think about tomorrow.

In his youth, Mr Price was a fan of Northern Soul dance music and attended the famous Wigan Casino nightclub, renowned for its all-nighters where talented dancers would show off their skills.

He likens good leadership to the ability to be on the dancefloor and simultaneously picture the view from the balcony, saying: “You are dancing away, sweating and grinding, and at the same time seeing the patterns from the balcony.”

One of Heidrick & Struggles’ studies asked people whether they aspired to be like their boss. The high-performing, superaccelerating companies scored highest, the failing companies scored lowest, reflecting the ability of great leaders to create connections and passion that cross hierarchies.

A second mindset that separates the front runners from the laggards is the difference between those who take the “these are my resources” approach and those who see their role as making the best match between resources and opportunity.

Don’t just run the race, lift your head up and look around you

There is a tendency in poorly performing organisations to build rigid structures and silos that are not only slow to adapt to change, but foster a tribal culture where resources are hoarded rather than shared.

A test of leadership is the ability of the CEO continually to reallocate capital, keep people mobile and rigorously share and reuse resources. It is a mindset focused on agility rather than stability.

Another mindset divides leaders between those who see every problem as an either/or issue and those who ask “How do I dissolve the paradox?”

Instead of seeing problems as binary or even trying to find some compromise by splitting the difference, the superaccelerator CEO sees ways of reframing the issue and making two contrasting objectives compatible. For instance, one way of achieving low cost and high quality is to invest in reducing service errors.

Adopting the right mindsets is only part of the puzzle of what makes a CEO of the future, but it is an important step.

Mr Price says that although acceleration is the key to performance, it is also important not to do everything at breakneck speed and to know when to slow down at critical moments.

The message to future CEOs is: “Don’t just run the race, lift your head up and look around you.”

For more information please visit www.heidrick.com