Many investment firms are looking to a future in which they meet their net-zero targets, achieving an overall balance between emissions produced and emissions taken out of the atmosphere. However, while much needed, setting these long-term targets does not always compensate for the environmental damage being done right now and companies should be taking full responsibility for all emissions that will be produced, both today and tomorrow.

“We need both longer-term plans for systemic change, as well as immediate action today. Ultimately, it is today’s emissions that are causing tomorrow’s climate change and we need organisations to take full responsibility for their carbon emissions now,” argues Vaughan Lindsay, chief executive of ClimateCare, the UK’s highest-scoring profit-for-purpose B Corporation that finances, manages and develops climate projects around the world.

Over the past 18 months, there has been a substantial shift in how many corporations think about the impact they are having on the environment. An increasing public awareness of climate change and changing consumer behaviours has catalysed this shift that, when combined with pressures coming from investors and governments, has driven increasing climate ambition and action in the investment space.

So much so, in fact, companies that have previously engaged with climate change mitigation mainly due to corporate social responsibility (CSR) are now beginning to see it as a “business-critical issue”, says Lindsay. But robust and transparent environmental, social and governance (ESG) policies that go beyond “do no harm” are no longer a nice to have, rather they are now fundamental to the success of every investment strategy.

“If organisations aren’t thinking about how to make their products and services climate neutral, consumers may not choose their brand, and they may well find it harder to attract new customers, retain existing customers and attract talent,” he says.

This increasing consumer awareness, and certainly the issue of consumers lobbying for change, have been highlighted time and again in research. A recent survey by B Lab UK and ReGenerate, for instance, revealed that 72 per cent of the UK population believe businesses should have a legal responsibility to the planet and people, alongside maximising profits.

Such consumer awareness is driving investment firms to take action. “We increasingly get inquiries from private equity houses and asset managers saying they’ve offset their business travel and office costs; they’ve done all that, but this is usually a very small part of their carbon footprint. What we then need to ascertain is what more they can do to strengthen their climate action across their entire investment portfolio,” explains Lindsay.

The next step is for investment companies to become climate-neutral investors. But what does this mean in practice? “It involves a whole suite of actions that include screening to avoid highly carbonised sectors, understanding the carbon footprint and awareness of their investee companies, taking action to reduce this carbon footprint and offsetting their residual emissions,” he says. “If we’re going to limit global warming and avoid catastrophic climate change, then we need to take full responsibility for our carbon emissions right now, to ensure that the journey to net zero is as fast as possible.”

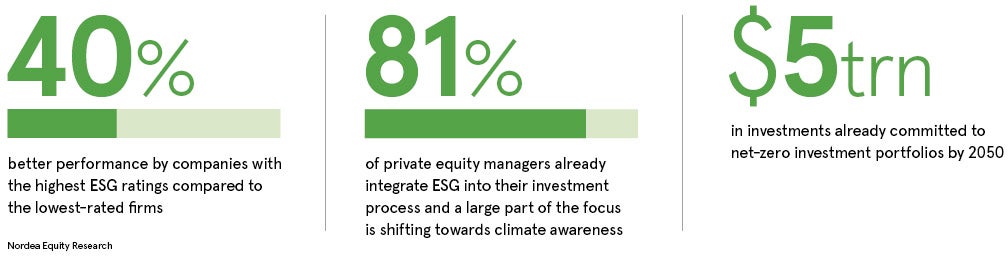

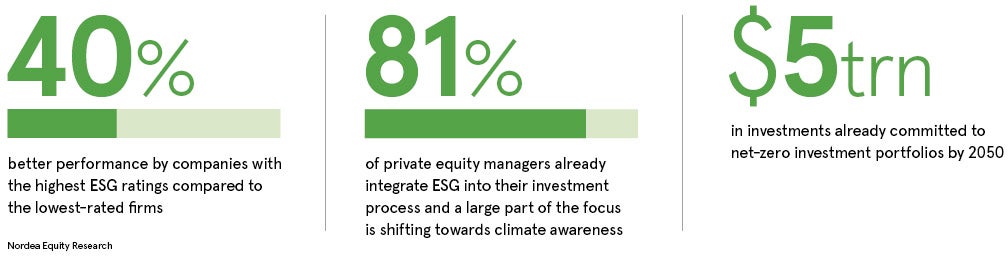

What are the benefits for investment companies by acting now to offset their emissions today? Lindsay argues that there are real benefits throughout the private equity cycle and points to the Nordea Equity Research report that found companies with the highest ESG ratings outperformed the lowest-rated firms by as much as 40 per cent.

It seems clear that a climate-neutral approach will indeed help private equity houses with raising funds, as investors are increasingly selecting those with strong climate credentials. Failing to do so may mean they lose out.

One of the private equity investment firms leading the charge on this is Triton Partners, a leading European firm invested in portfolio companies with combined sales of €17.4 billion. Part of Triton’s investment strategy is to increase environmental ambition across its investment portfolio. It does this by raising awareness of climate-related risks and opportunities, and supporting portfolio companies to take responsibility for carbon emissions through carbon offsetting.

Part of Triton’s investment strategy is to increase environmental ambition across its investment portfolio. It does this by raising awareness of climate-related risks and opportunities, and supporting portfolio companies to take responsibility for carbon emissions through carbon offsetting

ClimateCare worked closely with the Triton ESG team to create and deliver a sector-leading offsetting programme, which enables their portfolio companies to compensate for their emissions by supporting rainforest protection and renewable energy projects. As a result, Triton hopes to build the value and resilience of its portfolio. At the same time, it is preventing the release of around 300,000 tonnes of CO₂ a year into the atmosphere, empowering communities and protecting precious rainforest habitat, which is home to hundreds of endangered plants and animals.

Graeme Ardus, head of ESG at Triton, explains: “Offsetting with ClimateCare is part of a wider energy transition strategy for Triton that is focused on building better businesses by encouraging change through being more energy-efficient and adopting low carbon technology. Our role is to support that change for the better across our portfolio companies.”

With the expertise of organisations such as ClimateCare, investment companies can accelerate their ambition today by compensating for residual emissions with a robust carbon-offsetting programme. This strengthens both their value and brand.

With $5 trillion in investments already committed to net-zero investment portfolios by 2050, there is a real opportunity for changes ahead. As Lindsay says: “Helping investment firms unlock the trillions of dollars in the capital markets is the scale of ambition we need to tackle global climate change.”

And it’s not just in the investment sector that we’re seeing some great steps forward. Earlier this year, Microsoft announced that it plans to remove all the carbon the company has emitted by 2050, either directly or by electrical consumption, since its inception in 1975. “Those are some really exciting statements,” says Lindsay. “I think that it’s beginning to raise the bar and ambition about what positive corporate action looks like.”

Will other companies and industries follow suit? Absolutely. Lindsay explains he is already witnessing this. “We are seeing many investment companies taking full responsibility for their climate impact and in doing this they are demonstrating it is both good for the climate and good business,” he says.

Certainly, the time to act is now. A robust and transparent climate strategy is no longer optional in the investment sector. It’s an essential element of a successful investment strategy to attract new capital and manage

climate-related risks, and harnesses the opportunities of an economy transitioning to a low-carbon state.

To quote Larry Fink, chief executive of BlackRock: “Coming out of the crisis, we have an opportunity to accelerate towards a more sustainable world. The pandemic we’re experiencing now is further highlighting the value of sustainable portfolios.”

For more information please visit climatecare.org