The last major financial marketplace to be transformed by technology is the corporate bond market, but a new online trading venue is now providing access to fixed income in affordable sizes.

This sudden liberalisation of the main corporate bond markets amounts to something of a revolution. While in the UK, 53 per cent of pension investments go into bonds1, direct investment by individual investors in corporate bonds remains negligible. The European Commission recently called for the market to be enhanced2 and, with equity trading becoming more volatile, access to corporate bonds gives investors a means to buy in to those companies with greater security and reliable returns.

WiseAlpha, the UK’s leading digital bond market, has created a new bond-trading venue to cater for mass engagement. “Corporate bonds have traditionally been traded over the counter, by brokers on the phone, and with incredibly high minimum purchase sizes, meaning only institutional or seriously wealthy investors can play in the market. We are changing that completely,” says Rezaah Ahmad, founder and chief executive of the company.

The platform offers investors the chance to buy fractions of FTSE 250 size corporate bonds, for as little as £100. Ever since the bond market’s inception around 350 years ago, it has largely been closed off from individual investors, so WiseAlpha’s radical opening of access is being likened to the digital disruption in the travel industry and the high street.

“It’s crazy that private investors have been shut out from this market and even institutional trading has remained so old fashioned,” says Mr Ahmad. “WiseAlpha’s digital bond market has transformed access to this multi-trillion asset class, allowing investors of all sizes to tap into the stellar returns on offer. The democratisation of the bond market is in motion and it’s time for everyone to get on board.”

Underlying the new digital market is innovative technology that chops up large bond blocks into affordable, bite-sized pieces. “We’re scaling by fractionalising bonds and offering them to thousands of investors who buy and sell on the platform,” Mr Ahmad explains.

To use WiseAlpha’s bond market, investors simply sign up and choose from the many corporate bonds available. The range of options is large, with many of the biggest names in UK and European business listed on the platform. At any one time, the top-performing household name companies are available to invest in, from Ocado to Virgin Media and Burger King to Vodafone.

The platform’s development is well timed given the sustained growth in non-financial corporate bond issuance over the past decade and the simultaneous decline in equity listings. According to the Organisation for Economic Co-operation and Development, outstanding debt in the form of corporate bonds almost doubled in real terms between 2008 and 20183. Even for long-established listed companies, debt issuance in the form of bonds has become highly popular because of the quick access to money at fixed rates

and terms.

Prior to the inception of WiseAlpha, several attempts had been made to establish retail bond markets. In the UK, the most notable of these was the London Stock Exchange’s creation of the Orderbook for Retail Bonds (ORB) in 2010. But that bond market has seen low issuance in recent years and many long-established companies have not used it for listings.

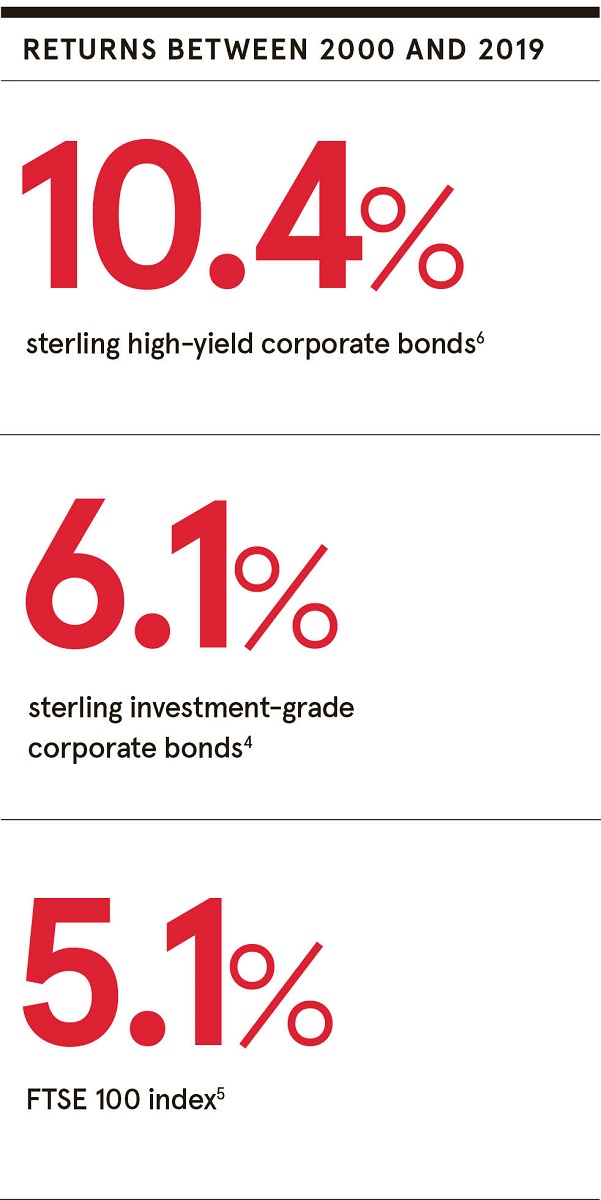

Investors using WiseAlpha can tap into the broad diversification and strong returns available from the wider corporate bond market. According to Barclays, over the last 20 years, sterling investment-grade corporate bonds returned 6.1 per cent4, compared with the 5.1 per cent available on FTSE 100 shares5. Sterling high-yield fixed income has generated 10.4 per cent6.

“Investors are wise to consider a more diverse portfolio to reduce their risk and with a much bigger weighting to fixed income. Corporate bonds are the perfect addition to a portfolio and their returns are consistently higher than stocks and shares over the medium term,” says Mr Ahmad.

For those new to investing or to corporate bonds, WiseAlpha also offers a robo-management solution called Robowise that allows users to manage their portfolios automatically, while still being able to tailor portfolio settings and take back control if they wish.

Crucially, reselling bonds to other users on the WiseAlpha marketplace is quick7. “We’re filling the access and liquidity gap, and it will become evermore liquid as thousands of investors continue to join,” says Mr Ahmad.

The market’s straightforward functionality is also proving attractive to stock-trading platforms and asset managers. “We are now implementing a wide range of partnerships with funds, banks, wealth managers, brokers and money apps to allow them to connect into our bond market so they can offer bonds to their customers,” adds Mr Ahmad. “We’re building a truly open bond ecosystem, bringing together retail and institutional fixed-income investors, and we’re hugely excited about continuing to grow the platform.”

Individual investors of all backgrounds are looking for better returns, to diversify their assets and mitigate risks in a constantly changing environment. Thanks to new technology, they can now access the reliable returns of the bond market much more easily than ever before. It is a clear opportunity that private investors are taking up in

large numbers.

To find out more about how to invest in bonds and grow your money reliably, starting today with as little as £100, please visit wisealpha.com