Even before the pandemic, many companies were facing important decisions about managing their finance operations. In 2021, those decisions are more pressing than ever.

Chief Financial Officers (CFO)s need to take a strategic view of managing the entire finance function, including their tax operation. Get it right and they can deliver long-term value, creating teams and processes that can cope with the road ahead, which has a series of very real challenges.

The challenge of digital tax

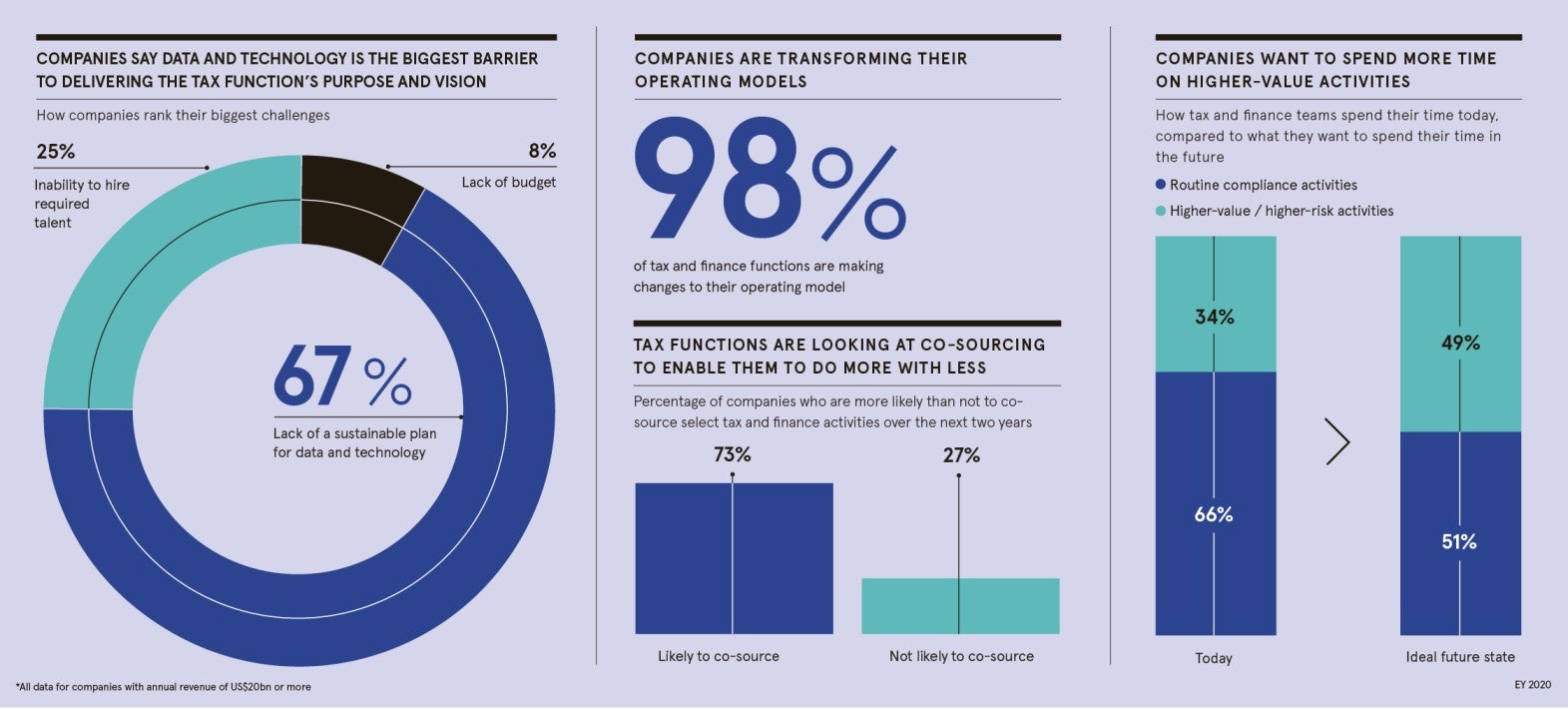

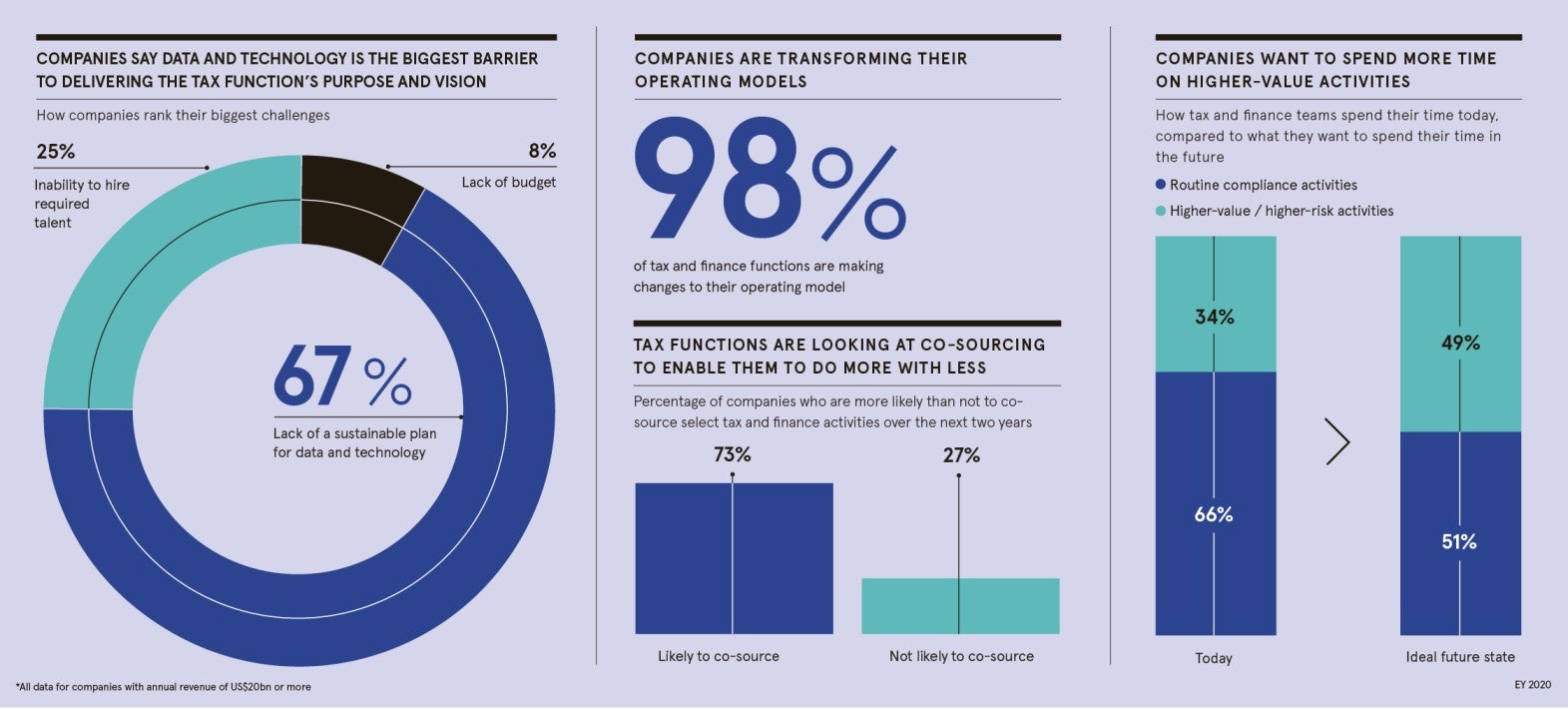

In the 2020 EY Tax and Finance Operate (TFO) survey of 1,013 tax and finance professionals, 67 per cent of the companies with annual revenues of US$20bn and above said the biggest barrier to achieving their vision for their tax and finance function was lack of a long-term, sustainable plan for data and technology.

These functions urgently need the transformation that modern technology platforms can bring. It is not just the ability to support seamless cooperation across global teams, essential though that is. They need flexibility, such as being able to produce new analytics and reporting when the business pivots. The technology platform also needs periodic updating as tax codes change and to incorporate state-of-the-art technologies when they become available.

For years, the finance function has been making trade-offs between risk, cost and adding value to the business; technology allows all three to be improved at once

Getting all this technology to work requires talent and there lies the second challenge. The CFO needs a skilled team that blends tax knowledge with technology insights plus an entrepreneurial, problem-solving mindset. Skilled people like these will only build a career with you if they solve interesting, strategic problems.

The third challenge facing companies is how to identify, interpret and then act on the many legislative and regulatory changes. For example, we have seen nearly 3,000 pandemic-related tax law changes offering incentives, relief and support to businesses just in the last year. But even before the pandemic, the pace of legislative change was rapid with governments seeking to capture revenue from digital services and cross-border commerce.

Governments are also expected to increase taxes as they manage deficits and debts exacerbated by the pandemic. And, they will continue to impose more digital filing requirements, demanding rapid reporting of more granular data, placing stress on tax compliance operations.

And there is a fourth challenge, which creates the perfect storm: the need to cut costs.

In light of these challenges, chief executives have increasingly been asking us how to drive more efficient tax and finance functions.

How can tax and finance professionals do more with less?

How can CFOs meet this long list of tough challenges? We argue that now is the time for a quick but thorough strategic review.

This review should be grounded in operational issues, but look above and beyond. It needs to consider broader matters, such as tax governance and how the company’s tax profile will be reflected in its reporting on environmental, social and governance (ESG) metrics. The focus should be on long-term value and not only quick fixes for today.

Then it is time to ask the critical question: which parts of the tax and finance function can your business sustainably own and operate? And which processes should be done with leading professional services organisations that can spread costs across thousands of companies?

Even before the pandemic, these were questions CFOs were asking. In our 2020 TFO survey, 98 per cent of large company respondents said they were transforming their tax and finance operating models and 73 per cent said they were more likely than not to co-source some critical activities in the next 24 months.

Is technology the key to finance transformation?

Many CFOs want to keep operating the higher-risk, higher-value processes in-house, such as strategic tax advice and complex tax policy and controversy matters. This makes sense: after all, that is what both they and their team are qualified to do.

Many organisations are looking to work with service providers such as EY, which is investing constantly in technology designed to help clients meet compliance obligations in a cost-efficient manner so that they stay current with rapid legislative and regulatory changes, which helps mitigate risk.

For instance, EY combines the cloud-based EY Global Tax Platform, which runs on Microsoft Azure, a secure, scalable and cost-effective platform, to deliver technical excellence with the support of EY professionals globally who bring a deep knowledge of tax to client service.

The EY Global Tax Platform can ingest a variety of data from many enterprise resource planning systems, and then validate and transform the data into a common model that can be used to facilitate routine compliance processes and drive reuse providing valuable analytics, planning, transparency through real-time dashboarding and management reporting.

And because the Global Tax Platform is a data management platform, built with state-of-the-art technologies in a plug-and-play fashion, it is easily updated as tax laws change and technology advances, making it a future-proof solution.

Building the modern finance function

The impact can be transformative. For years, the finance function has been making trade-offs between risk, cost and adding value to the business; technology allows all three to be improved at once.

Finance chiefs now have more choices than ever. Every organisation needs to decide on its mix of work done internally and that done with service providers. As our colleague Tim Steel, EY TFO leader for Europe, Middle East, India and Africa, notes: “Many companies will decide a hybrid approach is right for them, where they decide to continue to own some tax and finance functions they consider to be critical, while co-sourcing others.” He adds that this drives overall effectiveness and efficiency, while empowering their own people to focus on high-value strategic matters.

Creating this kind of vision is a challenge, but also an opportunity to reimagine the tax and finance function so it contributes to the company’s delivery of sustainable, long-term value to all its stakeholders.

To learn more please visit www.ey.com/tfo.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organisation or its member firms.

Sponsored by

Even before the pandemic, many companies were facing important decisions about managing their finance operations. In 2021, those decisions are more pressing than ever.

Chief Financial Officers (CFO)s need to take a strategic view of managing the entire finance function, including their tax operation. Get it right and they can deliver long-term value, creating teams and processes that can cope with the road ahead, which has a series of very real challenges.