Many people, fatigued by the recent scandals, volatility and vagaries of the financial markets, have lulled the investor inside themselves to sleep. Now it is time to come out of hibernation and wake up to the possibilities of responsible investment (RI), especially for investors in the UK who have some catching up to do.

Increasingly alarming daily headlines warn of the dangers of global warming, energy consumption and carbon emissions. Time is of the essence. There is only one world and everyone feels the urgency to act for change.

Consider that in 2017 Earth Overshoot Day – when humanity consumes more resources from nature than our planet can renew and regenerate in one year – was reached on August 2.

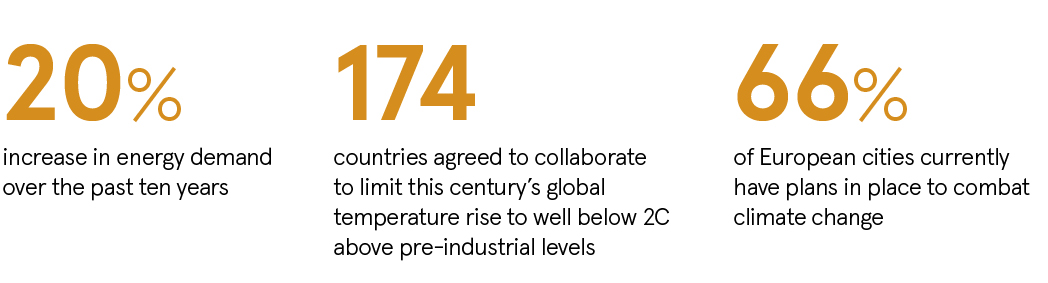

Less than a decade before, in 2008, it fell almost three months later, on October 26. The 2018 date is expected to be August 1, the earliest since records began; little wonder when energy demand has been dialled up by 20 per cent in the last ten years. Resources are being used faster than ever before. Ultimately, humans are living on credit and that is unsustainable in the long term.

Individuals, organisations, governments and public bodies around the world are finally taking a stand to combat the harsh realities of global warming and dwindling natural resources.

Following the 2015 United Nations Climate Change Conference, for instance, 174 countries agreed to do their bit to limit this century’s global temperature rise to “well below 2C above pre-industrial levels” and policymakers have been increasingly supporting economic growth. Further, 66 per cent of European cities currently have plans in place to combat climate change.

In the corporate world, barely a week passes without a major announcement from a big-brand organisation about its sustainability efforts. For example, adidas sold one million pairs of trainers made from ocean waste last year, while Volvo revealed plans to cease production of all petrol and diesel cars by 2019. Even in early-July, Starbucks just announced it plans to save one billion plastic straws every year by eliminating them from its 28,000 stores around the world.

Individuals, too, are improving their consumption habits. And the finance community is also catalysing powerful change. I believe we are rapidly approaching the tipping point where RI is no longer niche, but the norm.

Allocation of capital is increasingly merging the traditional strategy based purely on value with one based on values, which is focused on sustainability and creating long-term positive impacts upon the environment and society at large. That is because a greater number of stakeholders across the globe wish to invest in this way.

It should be noted that in the UK, where in general investors still tend to place a higher value on potential financial returns, there is much potential for RI.

As the popularity of RI has mushroomed in the last five years, plenty of greenwashed participants have joined the bandwagon, looking solely to chase marketing and business objectives. Meaningful RI is possible, provided the investor uses specialist asset managers who are genuinely socially committed, savvy and innovative enough, rather than it being a marketing exercise.

It is vital for investors to discern the serious players, such as Candriam Investors Group, which boasts a 20-strong team dedicated to a granular analysis of environmental, social and governance (ESG) factors way beyond financial statements and prospects for every single investment.

Indeed, Candriam is a pioneer in this space, having launched its first RI strategies in 1996. Over the years we have significantly increased our range of RI capabilities, and right now we provide our investors with the broadest scope of RI portfolios and services in Europe. Some €30 billion (£26.5 billion), a quarter of the value of the assets we manage, is invested in institutions leading the way in sustainability.

Candriam offers a holistic approach. Our core conviction has been that investment opportunities and risks cannot be fully evaluated using traditional financial measures alone; to ensure a complete view of each organisation’s prospects, it is imperative to consider its ESG practices.

Evidence shows there is a positive relationship between a company’s ESG performance and its financial returns

Evidence shows there is a positive relationship between a company’s ESG performance and its financial returns. However, it is crucial to stress that the full value created by RI funds will not be realised within six months; these are long-term commitments. They can offer good returns, but it is important not to benchmark them against investment strategies that capture short-term market effects.

Developments in climate change, wellness, electric vehicles and so on will not happen quickly. The essential longer-term view might come easier to younger investors, such as millennials, who take action with their own future in mind.

RI represents a win-win situation, though, whereby both the investor and the planet benefit. That is why leading RI asset managers, who have the knowledge and tools to identify the likely long-term winners early, are well worth seeking out.

There is great momentum for change, but time is running out. Everything is in place for sustainable growth acceleration, though the transformation at stake, for which expert asset managers can be pivotal, requires enormous amounts of funding.

Investment firms and their clients, including you, have a huge role to play in making finance great again and, moreover, improving the state of the world for generations to come.

For more information please visit candriam.co.uk