Even before coronavirus disruption, radical changes had been afoot in the private wealth sector for some time. Recovery from the global financial crisis of 2008 was made more challenging by new regulations aimed at preventing a repeat and all the while new upstarts from a burgeoning fintech sector were able to respond to consumers’ digital expectations faster. The pandemic then amplified the need for digitalisation in the private wealth sector.

Wealth, in itself, has taken on new meaning, driven by the rise of mass affluent segments in developed economies and a growing middle class in emerging markets. Traditional wealth, as defined by high or ultra high net worth, has also seen major changes through a generational transfer of trillions to millennial and post-millennial generations, who are not only digitally native, but also have different views on money than their predecessors.

Deeper understanding of digital

Digital transformation, albeit much hyped, was previously misunderstood and incomplete. The adoption of “point solutions”, which focused primarily on the user experience and at the frontend, did little for integrated, enterprise-wide digital workflows and operational fabric.

True and comprehensive digital transformation affects the highest-level strategy, process design, operations and business models. It radically changes the role of people in front-to-back operations and the way they use technology.

Improving user interfaces or back-office operational efficiency leaves the institutions partly digitalised, but unable to benefit due to disconnects between functions and business units in their levels of digital adoption. Only full, cross-functional, end-to-end digitalisation can ensure return on investment and positive outcomes.

A modern Investment Management solution must leverage a total portfolio approach to generate alpha in terms of stronger returns and higher quality of investments

Gaining tangible value from digital change starts by building a reliable, open and consistent digital business data layer, which empowers clients to access their investment information and provides advisers with relevant, real-time and actionable insights to act on.

Secondly, it requires a digital customer experience delivered through the optimal channel mix, enhancing timely and personalised interactions anytime and anywhere. Finally, digital must be a new standard, completing the “open wealth” architecture with digital native business processes.

Digital transformation is a journey, not a destination. There is no end state to the required technological and cultural changes; it is a continuous process of evolving capabilities to meet evolving needs and markets. This makes long-term planning a critical priority, roadmapping phased adoptions and transitions, and optimising resource allocation for maximum outcomes.

Tech vendors must play a valuable collaborative role in this process and Objectway, a digital wealth and asset management technology and services provider, has a track record of assisting wealth managers’ strategic digitalisation plans.

All about the customer

The wealth management sector is rediscovering the imperatives of customer centricity. Traditionally providing tailored experiences in a relationship-based business, firms are now adapting to new client expectations in the digital world.

The early months of the pandemic were a wake-up call that excellent in-person service is no longer enough and even a well-designed website does not meet diverse interaction requirements. This realisation triggered a catch-up rush to innovate customer engagement with digital tools and solutions.

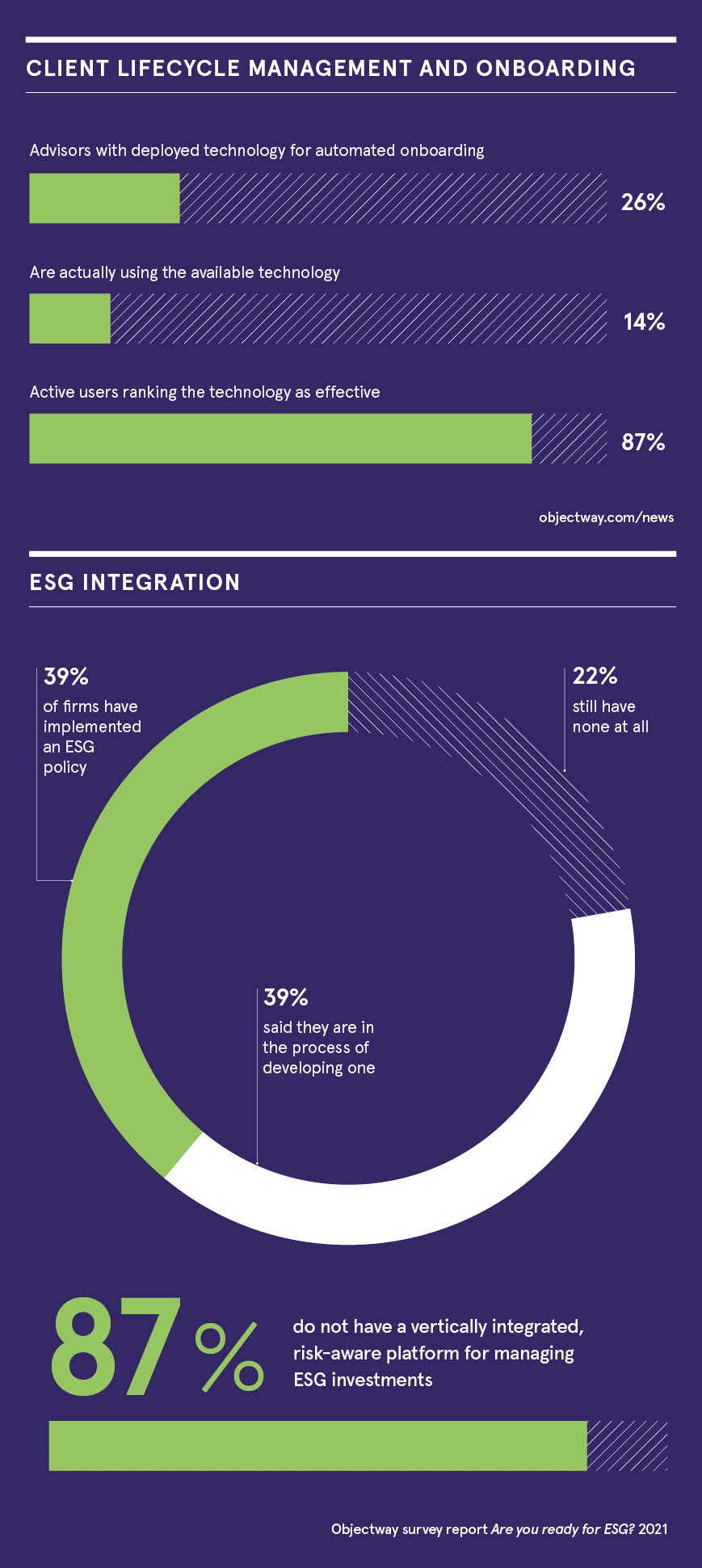

Onboarding new customers is a critical life-cycle event that remains a challenge for most firms and a weakness for many. In a recent news release, Objectway reported a Gartner study in which only 26 per cent of advisers said automated client onboarding was available at their firm and just 14 per cent were actually utilising it.

Despite the low adoption, 87 per cent of advisers using the technology ranked it as effective. Best-practice solutions include process-oriented client life-cycle management with advanced digital onboarding, combined with opti-channel and omni-device portals and native apps for superior user experiences.

Managing wealth remains at the core

While the fundamental objectives of wealth management are unchanged – wealth preservation and growth – the requirements are shifting and increasingly complex. Diminishing returns from traditional investments have increased interest in new and alternative asset classes: from real estate and private equity to cryptocurrencies and tokenised assets.

Sustainability, meanwhile, is no longer a fringe concept. Client interest has placed environmental, social and governance (ESG) investing centre stage, though wealth managers are yet to fully embrace it.

A recent Objectway survey found that only 39 per cent of firms have implemented an ESG policy, another 39 per cent are developing one and 22 per cent have none at all. Nearly 90 per cent of firms said they do not have a risk-aware, vertically integrated platform to manage ESG investments.

A complete solution requires ex-ante analysis of risk and sustainability, validated by ex-post monitoring and relied-on processes that take into account the risk tolerance and characteristics of the end-customer while respecting the sustainability criteria.

Objectway helps wealth managers to achieve higher returns from ESG integration through its end-to-end, risk-aware investment management solution RiskTech.

Wealth and investment management firms are also seeking to move away from decoupled and independent IT systems, and towards a fully integrated wealth ecosystem that handles all business operations.

Such a platform must leverage a total portfolio approach to generate alpha in terms of stronger returns and higher quality of investments. That would typically require a front-to-back open and modular suite providing a digital integrated experience to both wealth management professionals and customers, with a client experience portal, client life-cycle management, artificial intelligence-based portfolio and risk management, and securities accounting.

Objectway’s WealthTech Suite won the XCelent award for Breadth of Functionality and for Client Base. Research and consulting firm Celent also commended Objectway’s portfolio management and advisory solution, adviser and investor portal and mobile apps, as well as its client life-cycle management and onboarding solutions, saying they are “rich with capabilities that ultimately augment adviser–client interaction, drilled-down automated reporting, adviser efficiency and comprehensive key performance indicators”.

Living and operating in ecosystems

Today’s interconnected world is made up of fully integrated technology ecosystems and architectures with flexible modular structure and advanced, broad application programming interface (API) capabilities, which enable and enhance operating models like software as a service and business process as a service. The cloud, public, private or hybrid, is the ultimate ecosystem, with Objectway already supporting more than 100 clients with over €1 trillion of assets under management.

On the business side, partner and other stakeholder ecosystems enable collaborative engagement with other solution providers to maximise the value to client firms and their customers. Tech vendors can act as trusted partners of their clients in digital transformation and the delivery of evolving capabilities. This is one Objectway philosophy and strategy, tested in long-term relationships with some of the most successful players in the industry.

For more information please visit objectway.com

Promoted by Objectway

Even before coronavirus disruption, radical changes had been afoot in the private wealth sector for some time. Recovery from the global financial crisis of 2008 was made more challenging by new regulations aimed at preventing a repeat and all the while new upstarts from a burgeoning fintech sector were able to respond to consumers’ digital expectations faster. The pandemic then amplified the need for digitalisation in the private wealth sector.

Wealth, in itself, has taken on new meaning, driven by the rise of mass affluent segments in developed economies and a growing middle class in emerging markets. Traditional wealth, as defined by high or ultra high net worth, has also seen major changes through a generational transfer of trillions to millennial and post-millennial generations, who are not only digitally native, but also have different views on money than their predecessors.

Deeper understanding of digital

Digital transformation, albeit much hyped, was previously misunderstood and incomplete. The adoption of “point solutions”, which focused primarily on the user experience and at the frontend, did little for integrated, enterprise-wide digital workflows and operational fabric.