If fourth-generation networking transformed communication by connecting more people, the revolution of 5G will be connecting more things. The promise of lower latency and increased bandwidth is expected to usher in industry 4.0 and the industrial internet of things (IIoT). However, it’s the 5G networks’ ability to deliver these benefits from a dedicated, private network that is both cost effective and easy to deploy that could be the real game-changer.

Encompassing micro towers and small cells, which can in some cases be assembled in a matter of hours, a private 5G network can be built to service a specific geographical area for better coverage, increased control and security.

Public vs private 5G network

Unlike the public network its access is restricted, and because it can be “sliced” or “segmented” critical functions can be prioritised and run completely uninterrupted. This is particularly important for industrial applications, says Dritan Kaleshi, head of 5G technology at UK tech accelerator Digital Catapult.

“If companies are using cellular systems to run automated robots and cranes that are co-ordinating with one another and working around people, prioritising these functions over others is extremely important,” he says.

Overall, the isolation of a private cellular network can guarantee 5G services and increase security, says Chris Allen at mobile private networking at Vodafone Business.

“Historically, this hasn’t been possible because of the unpredictable nature of the general public, but with a private network we will know a company’s usage profile and can specifically dimension it to guarantee their needs,” he explains.

Industries ripe for transformation

Private LTE (long-term evolution) networks are not new, but nor are they widespread. However, because 5G supports large-scale deployment of time-saving technologies, such as holograms, high-definition video and automated heavy industrial equipment, the business case for private 5G networking is expected to be more universal.

Hardware manufacturers, telcos and original equipment manufacturers are keen to demonstrate the 5G business case and there are many trials underway trying to do this.

Vodafone, for example, has deployed a 5G private network at a gas terminal to improve productivity by ending paper processes and implementing predictive maintenance. According to Allen, the network and new processes it has enabled will save the company £5 million in one year.

Furthermore, as part of the European Union-funded MoNArch project, the Hamburg Port Authority, Deutsche Telekom and Nokia are testing a 5G dedicated network at the port to transmit movement and environmental data in real time across large areas. Other industries nascently deploying the technology include healthcare, airports and mining.

Kaleshi, however, says the media industry will be one of the early adopters. “There’s an opportunity for immediate uptake in the creative industries that typically depend on very high-capacity and very fast communication, which is 5G,” he says.

In January, telecommunications provider Swisscom tested a private 5G network at the 2020 Youth Olympic Games in Switzerland. Connecting all the production equipment at the venue wirelessly greatly reduced equipment installation time and the required manpower.

Manufacturing and private 5G

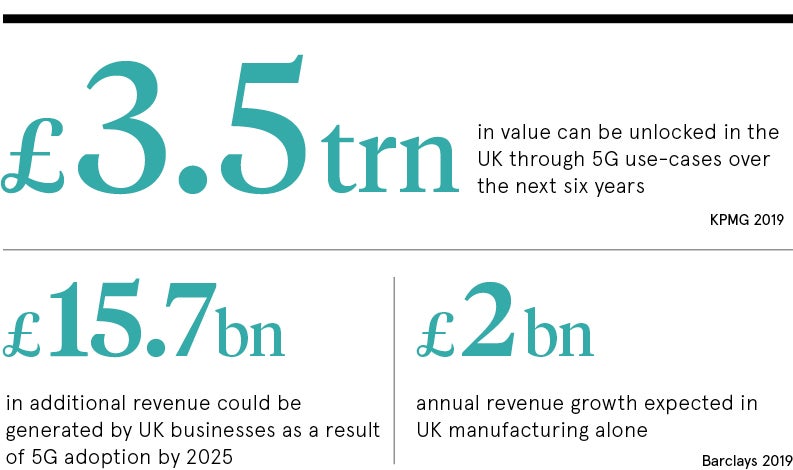

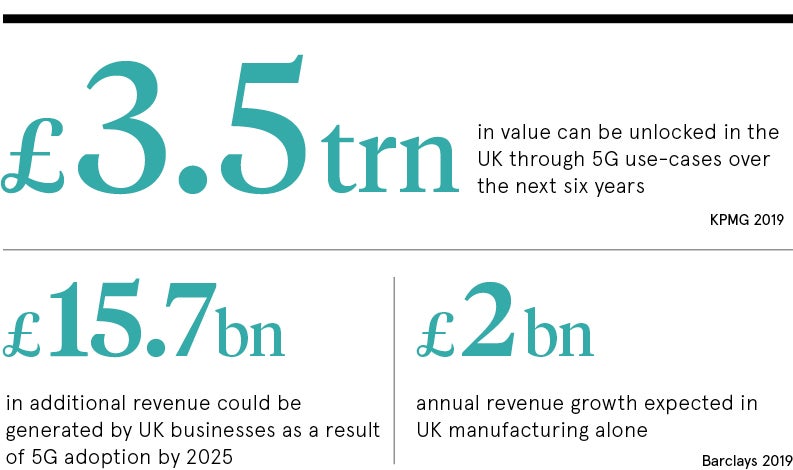

In particular, manufacturing is considered ripe for transformation via 5G private networks. Barclays estimates widespread adoption in the UK manufacturing sector could add £2 billion in revenue by 2025.

Wireless 5G connectivity can free manufacturing machines of cables, making it easier to change assembly lines and connect robots for fully automated processes and new revenue opportunities, says Iain Thornhill, vice president, service providers and IoT, at Ericsson.

“Car manufacturers can customise their cars much more easily and then sell them as a premium product; that’s a prime example of increased revenue generation and competitive advantage,” he says.

Robert Franks, managing director at West Midlands 5G, a public and private-funded 5G accelerator that is setting up test beds to give local businesses access to private 5G networking, says the technology can greatly improve manufacturing productivity.

“It’s been shown that using dedicated private 5G networks for predictive maintenance, for example, can improve productivity by up to 2 per cent because it reduces the cost of failure,” he says.

Though several manufacturers are investing, most notably German carmakers Mercedes Benz and e.GO Mobile, the sector is still figuring out the use-cases. More than 70 per cent of manufacturers surveyed for Digital Catapult’s Made in 5G report noted a lack of demonstrable return on investment as the main barrier to adoption. Kaleshi says, however, he anticipates an announcement soon relating to a new public-private consortium that will look at these barriers.

Shoring up the 5G business case

Proponents of 5G private networking say costs for hardware and installation should fall as chipsets become more standardised and more players compete to enter the marketplace. This will help small and medium-sized enterprises (SMEs) take advantages of the potential productivity gains.

“From a West Midlands points of view, it’s critical the technology is deployed, not just in the largest enterprises, but also in the SMEs because those businesses account for around 95 per cent of the value of the output for manufacturing locally,” says Franks.

Like in Germany, the UK regulator Ofcom is allowing any organisation to purchase spectrum, which means any company can operate a private network independently, as opposed to having a managed service from an operator.

“If you build it yourself, it’s likely to be capital intensive, whereas if you buy it as a managed service, you can spread out the cost, but you won’t own the asset and will have ongoing payments,” explains Kaleshi.

Thornhill says while making spectrum more accessible is good for the market, the operators will still play a major role in the ecosystem.

“In most cases we will see the service providers involved as they are needed to guarantee the quality of service, to run it and provide enterprises with value-add around delivery, such as monitoring, security and other areas,” he says

It is early days for 5G private networking, with most experts estimating the sector will kick-off properly in two to three years. Right now, however, the sweet spot for deployment is with the big industrial companies, airports and ports, says Allen.

“If you are a smaller company, unless you have a very niche use-case, it’s probably not for you right now, but it will be in the future,” he concludes.

Public vs private 5G network

Industries ripe for transformation