These may be times of global uncertainty, but when events get ugly, the beauty industry is able to sit pretty.

These may be times of global uncertainty, but when events get ugly, the beauty industry is able to sit pretty.

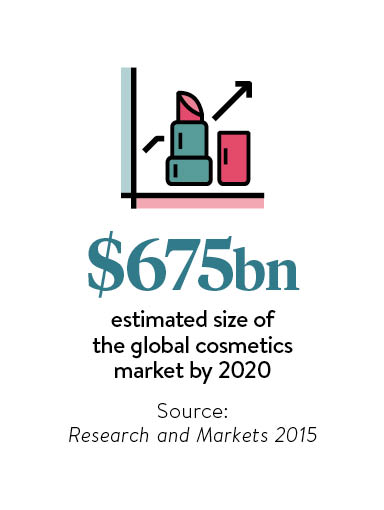

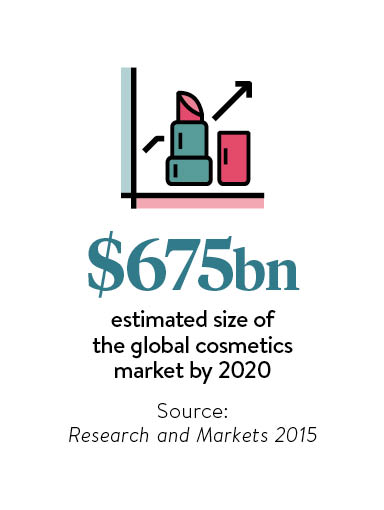

Analysts at Research and Markets predict global cosmetics sales will reach $675 billion by 2020. While in the UK, according to the Cosmetic and Perfumery Retailers Association (COPRA), sales have topped the £4 billion mark for the first time, overtaking the French market.

“It’s been an exciting year for the beauty industry,” says COPRA vice chairman Rakesh Aggarwal. “The UK market is now twice the size of the Italian and Spanish beauty markets, and only Germany is bigger in Europe.”

Premium cosmetics are booming despite, or possibly because of, economic worries. Leonard Lauder, Estée Lauder chairman, coined the phrase “the lipstick index”. When budgets are tight, he opined, women seek their retail therapy from a relatively inexpensive lipstick.

According to COPRA, the UK beauty market has seen double-digit growth in make-up sales with the prestige, luxury market accounting for £2.4 billion – a jump of £110 million over 2014.

“The strength in colour cosmetics sales growth lies in luxury products, which are growing at nearly twice the pace of the mass market,” says Charlotte Libby, senior beauty analyst at market research company Mintel.

Socialising beauty

Social media has also influenced demand. Beauty retailer Space NK has seen a 27 per cent rise in sales of highlighting, contouring and concealing products for the perfect selfie.

This year’s highest profile cosmetics launch was Victoria Beckham’s glamorous collaboration with Estée Lauder, which saw the former Spice Girl offering a tutorial for her 12.9 million Instagram followers. Its combination of luxury, digital and personalisation encapsulates key beauty trends.

Wendy Lewis, founder and editor in chief of lifestyle blog Beauty in the Bag, says: “Digital beauty is all about enhancing the customer experience. We all live 24/7 on our devices and beauty brands have capitalised on this megatrend.”

Ms Lewis says the hottest digital platforms at the moment are Instagram, which has more than 400 million active monthly users, and Snapchat.

According to Mintel: “Brands are utilising platforms like Snapchat, WhatsApp and Facebook Messenger to instantly connect with consumers and offer superior levels of customer service.” The market researchers predict that in the future people will “speak as easily and informally to brands as they would their friends”.

Celebrities, bloggers and vloggers remain important as influencers. Mintel says 20 per cent of make-up buyers seek out products to create looks they’ve seen on video tutorials, while 16 per cent say they buy from brands that have collaborated with their favourite designers, celebrities and bloggers.

We all live 24/7 on our devices and beauty brands have capitalised on this megatrend

Kathy Wrennall, founder of social media marketing agency Not Just Powder, says: “Seventy four per cent of consumers rely on social media to make a beauty buying decision.”

However, Ms Lewis cautions: “Consumers are being inundated with influencer content and have become more selective. Authenticity is cited as the key differentiator as beauty buyers decide whose opinion matters.”

This has led to a growth in interactive, consumer-generated content. Despite having no background in the beauty industry, Julia Langton founded a Facebook beauty group, Mrs Gloss and the Gloss, in June 2015. It now has around 30,000 members and sees 300 posts a day. She says not only do members recommend existing purchases to each other, but “people will take a picture of a lipstick in-store, ask if it’s any good and get replies instantly before making a decision to buy”.

Online shopping

Social media platforms have helped niche brands grow. Dedicated beauty stores offer a curated selection of small brands, which have often found online success first, and department stores are increasingly following their lead.

“Online has changed the economics of the business,” says Javier Escalante, an analyst at Consumer Edge Research in the United States. “Winners are the tiny companies.”

Grace Fodor, founder of Studio 10, aimed at the beauty market for older women. “Digital is a level playing field. Thanks to social media and influencers, we can both be a global brand and connect intimately with our customers. We can listen to them and respond to their needs as they age,” she says.

“The average woman spends £43,000 on beauty between ages of 50 and 70. Research shows 62 per cent of beauty products and toiletries are purchased by over-45s.”

However, research by IM Associates found fewer than half of these women enjoy buying beauty products in-store, as they are alienated by young assistants, leaving them rich pickings for e-tailers.

According to COPRA, online sales enjoyed a 38 per cent sales boost last year. Analysts at Verdict Retail predicted an 80 per cent growth in the online health and beauty market between 2015 and 2019. Ease of purchase and 24/7 availability is important.

But Mr Aggarwal, who is chief executive of e-tailer Escentual, adds: “The market is also very driven on price. UK retailers offer the most generous discounts in Europe.”

Ms Wrennall concludes that stores win for hands-on experiences and glamour. But better customer care and personalisation, with live advisers or increasingly sophisticated chatbots, or in the case of Avon a new digital platform consisting of a 24/7 online site run by a local representative who can even hand-deliver items, means going online is becoming an alluring alternative.