Workplace pension schemes have undergone massive changes in a short space of time. Through auto-enrolment, more employees are starting their pensions saving sooner, while the new pension freedoms have left those closer to retirement with some big decisions to make about their financial futures.

This is a step change for employees, who for the most part have never really engaged with pensions and never wanted to have to make those decisions.

Charlie Reading, founder of pensions and investment advisers Efficient Portfolio, says: “In years gone by, most people just bought an annuity at retirement. Many of them didn’t even look for the best annuity rate and usually took the easiest route. Now, that easiest route can cause more damage for them long term than it could before.”

Confused about what the pension changes will mean for them personally, many employees are looking to their employer to provide the help and support they need in the shape of financial education.

Research carried out 12 months ago by financial advisers Foster Denovo found that 50 per cent of employers surveyed said they had been asked by their employees for workplace financial education.

Offering financial advice

A year on, employers are still not delivering, according to the latest research from Workplace Savings and Benefits, which found that only 30 per cent have a financial education programme currently in place, 21 per cent of which were accessible to all employees.

There is no legal requirement for employers to provide financial education for their staff, but for those who do it can pay dividends, as employees who feel they have clearer understanding of their personal finances are likely to be more focused on their work and therefore more productive.

So what is holding the other 70 per cent of employers back? In the current regulatory climate, some are wary of the line between providing generic guidance, which they are permitted to do, and offering personal financial planning advice, which they are not.

Weighing up the options

One of the recommendations in the recent Work and Pensions Committee report on pensions freedoms was for the government to clarify the distinction between guidance and advice.

Cost is another deterrent although within the remit of providing financial guidance employers have quite a broad range of options.

A more affordable alternative for employers could be to pay for an IFA to deliver group seminars

Paying for employees to have one-to-one sessions with an independent financial adviser (IFA) would be one of the most expensive ways of delivering workplace financial education.

A more affordable alternative would be to pay for an IFA to deliver group seminars and offer individual employees, who want to follow it up with personal one-to-one advice, the opportunity at their own expense.

Companies with heavy defined benefit (DB) obligations may be keener on providing information and education on employees’ pension options.

Andrew Power, investment management partner at Deloitte UK, explains: “Some employees may decide to forfeit their DB rights in exchange for an enhanced transfer value into a defined contribution (DC) plan, which reduces the employers’ future pensions liabilities.”

Another barrier to employer investment in financial education is the prospect of employees leaving them before they retire, which can often be the case in high-turnover industries.

For smaller firms, providing workplace pension education is particularly challenging, explains Richard Brand, financial adviser at Eos Wealth Management.

“It’s tempting for the owners of small companies to do the bare minimum in relation to auto-enrolment, set up a pension scheme and then leave their employees to it,” he says. “However, offering financial advice sessions to staff is an employee benefit that can play a key role in both the recruitment and retention of committed employees.

“There is an important pastoral element too. Employees don’t just need expert advice to make the most of their pensions, but would really appreciate guidance on their other big financial questions about mortgages and student debt.”

At the very least, employers can direct their employees to some of the free online resources. For example, the Money Advice Service has lots of impartial advice, and Pension Wise is backed by the government and offers free advice for anyone approaching retirement age.

There is a compelling business case for making financial education a core benefits offering, not least because it can be a key to attracting and retaining talent

In addition, many pension providers have developed online tools that employees can access via the employer’s company website. These include interactive features, informative videos and personal finance modelling tools. This can be the most cost-effective way of equipping employees with the knowledge and support they need to make important decisions about their financial security in later life. With the provider taking responsibility, the employer has no need to worry about the regulatory risks of giving advice.

And yet, many employers are still not making the connection between workplace financial education and employee engagement.

Engaging your employees

“With auto-enrolment requiring companies to have pension schemes, the main focus has been on meeting the legislation requirements rather than education,” says Efficient Portfolio’s Mr Reading. “Unless the people at the top of the organisation are fully engaged themselves, the rest of the workforce won’t be either. I think this is partly because the pension landscape is changing so quickly that they themselves cannot keep up.”

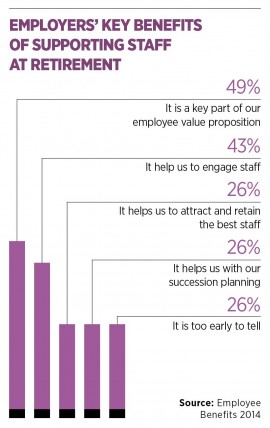

Nevertheless, there is a compelling business case for making financial education a core benefits offering, not least because it can be a key to attracting and retaining talent, currently a top priority for all organisations.

Alison Dodd, chief executive at HR and payroll services provider Moorepay, says they are seeing an upswing in interest in employee education, from both employers and employees.

“It is difficult to measure the success of such offers; however, the increased uptake of financial education does show that companies see it as beneficial, either to their bottom line or to their overall productivity.”

There is also scope for broadening the workplace financial education remit with the aim of helping all employees, not just those nearing retirement, get to grips with other aspects of their personal finances they find challenging and stressful.

And regardless of how they choose to provide that education, when it comes to a return on their investment, they stand to reap significant business benefits.

Offering financial advice