Monzo Bank, the mobile-only banking service launched in 2015, is taking personalisation to a new level, according to chief executive and co-founder Tom Blomfield.

The bank is using data on customers’ spending habits to advise them how to save money. For instance, the bank’s data shows that 30,000 customers use their Monzo cards for pay-as-you-go Transport for London trips on tubes and buses every day.

“We have data on those people, we know where they live, we know where they travel to, we know how much they spend. We can suggest to these people that actually they would be better off getting a year-long travel card and save a couple of hundred pounds,” says Mr Blomfield.

Analysing data to help customers improve their finances will, he believes, be the future for financial services brands over coming years. Monzo offers customers financial advice based on their spending patterns and helps them to save money, budget responsibly and to find the best deals, he claims.

For instance, its algorithms can tell when a customer has moved from paying a monthly money-saving tariff for gas and electricity on to a more expensive standard variable rate. It can then suggest to the customer that they could save money by finding a new supplier. The bank also uses geo-location data from customers’ phones, so when they go abroad it can offer them a competitive currency exchange rate.

One of the new breed of mobile-only banks, such as Atom Bank and Starling Bank, Monzo offers heightened levels of personalisation to customers. Atom Bank allows customers to customise their app with their own logo, and they can choose the colour scheme for their home page and invent a name for their bank, for instance “Jenny Bank”.

Monzo offers a top-up debit card and has attracted 250,000 customers, with 150,000 using its services every week. In the next few months, it will launch its first current account where people can pay their salaries and run all their banking services.

Mr Blomfield explains his vision for the future. “We see ourselves as custodians of not just your money, but of your data and making that data work for you,” he says. “We want to be a financial control centre that is totally personalised to you and which helps you live your life.”

Personalisation through data

Personalisation has been a long-held dream of banks and financial brands. They have access to huge amounts of data about their customers and believe they can analyse this to predict when is the best time to offer loans, mortgages, insurance policies and other products to customers.

First Direct bank launched in 1989 with a strongly personalised approach. That meant not only using data to predict what products customers would need, but answering customer calls with a human assistant, rather than an automated call handler. These days technology has developed to such an extent that banks feel they can offer customised services through analysis of data and transactions.

But some wonder whether financial services brands have really cracked personalisation. “At the moment, we are still in a period where a lot of personalisation seems pointless, gimmicky or in some cases just plain wrong. There are firms that are so keen to personalise that they are using inadequate data and just getting it wrong,” says financial consultant Lucian Camp.

An often-cited example of the way financial brands can bring new levels of personalisation is the use of geo-positioning data from mobile phones to judge when a customer is visiting a car showroom. A financial brand could then send them an offer of a car loan at a competitive rate. Mr Camp says this seems a smart use of personalisation as the loan could offer a better rate than the car dealer’s. But he warns that such a personalised loan offer would look inappropriate if the customer had simply dropped into the showroom to book a service for the car.

Monzo’s Mr Blomfield believes that established banks are taking the wrong approach to personalisation. “The problem that I see with traditional banks and when they speak about personalisation is that it is always a way of selling more financial products. They never seem to think how can we use this to really help our customers?” he says.

Even so, traditional financial services brands could find that data personalisation based on analysis of data transforms their relationships with customers. Abhijit Deb, head of banking and financial services in the UK and Ireland at technology company Cognizant, says personalisation will allow financial services brands to become more like lifestyle brands.

Financial brands sense that with the advent of big data analysis, the personalisation moment has arrived

“The last few years have seen banks, card issuers and lenders push the boundaries of personalisation to try to ‘understand and own’ their customer interactions,” he says. This is part of a strategy to promote customer loyalty and boost cross-selling and up-selling, where companies try to sell customers more expensive products.

But he adds: “Financial services providers realise that they need to go beyond simple transactional relationships and move into lifestyle-based banking, where they are at the centre of any financial decision their customers make.”

Bank brands could build greater loyalty with their customers through ramping up their personalisation strategies. In one study of affluent bank customers, 56 per cent of respondents said they would feel greater loyalty towards brands that know who they are and treat them differently to other customers. The research by Collinson Group shows that nearly three in five expected their bank to offer products and services that met their needs. And more than two thirds of customers expected their bank to reward them for staying loyal.

“By offering more personalised rewards and cross-selling relevant products, financial services organisations boost revenues while ensuring their customers feel recognised and valued, keeping them loyal in the long run,” says Christopher Evans, director of Collinson Group.

Financial brands sense that with the advent of big data analysis, the personalisation moment has arrived. Personalisation should mean that bank customers receive fewer unwelcome communications and more offers that are relevant to their needs.

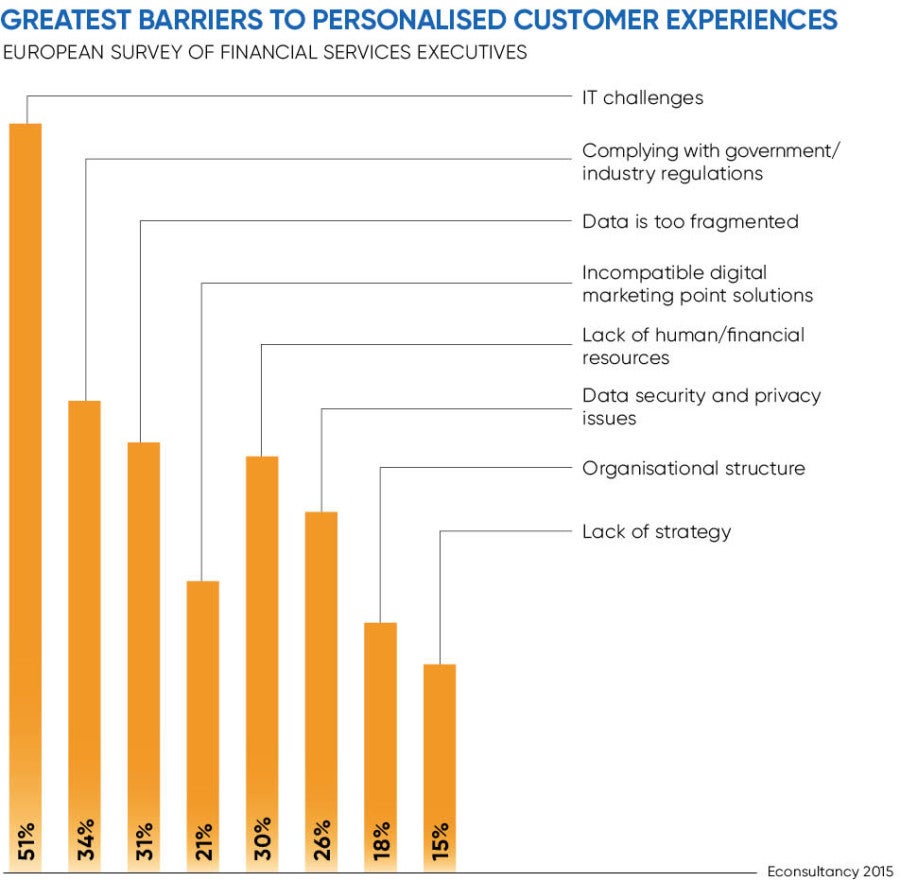

Mr Camp says the move from mass-marketing of financial services to an era of personalised marketing should benefit customers. But he adds that this transformation is more challenging than had been expected. “It is just taking a bit longer; the challenges of making the transition are just a bit harder, more expensive and more complicated than we thought they were going to be,” he says. Customers may have to wait a bit longer for financial services which are truly personalised.